SGX-listed real estate companies UOL Group (SG:U14) and Lendlease Global Commercial REIT (SG:JYEU) have received Buy ratings from analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Singapore real estate market has witnessed an increase in prices as well as rents in the last few years. Analysts expect the Singapore real estate market to remain bright in 2023 after withstanding so many headwinds in 2022. China’s reopening and the return of tourists to Singapore will further push the retail and high-end residential markets in the country.

Here, the TipRanks Singapore Real Estate Stocks data came in handy to screen these two stocks. Such sector-specific tools for different markets help investors do in-depth research and choose the stocks accordingly.

Let’s dig into more details on these companies.

UOL Group Limited

UOL is a leading property and hospitality company with a diversified portfolio of assets across Asia, Europe, Oceania, and North America.

In February, the company announced its 2022 annual results, which were within analysts’ expectations. The company posted a growth of 28% in its full-year revenues of S$3.2 billion, driven by property development and the bounce back of the hotel segment. The net profit grew by 54% in 2022 to S$768 million, up from S$499 million in 2021.

Following its results, analysts have reiterated their Buy rating on the stock. Analyst Derek Tan from DBS feels the numbers were pushed higher by its hotel operations and the RevPAR (revenue per available room). This also led to higher profit margins of 33% for the company.

Tan remains optimistic about the company’s hospitality segment in 2023, given the further growth in travel demand from Chinese tourists. This will also be supported by the company’s pipeline of 18 more hotels in the coming years.

UOL Share Price Target

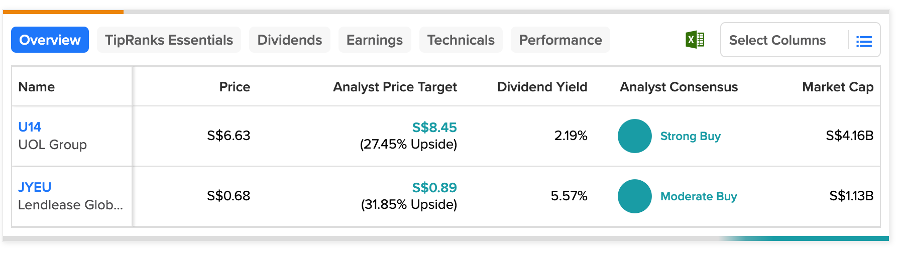

According to TipRanks, U14 stock has a Strong Buy rating, based on all three Buy recommendations.

The average price target is S$8.45, which implies an upside of 27.4% from its current price level.

Lendlease Global Commercial REIT

Lendlease is a Singapore-based REIT that invests in and owns a diverse portfolio of income-producing real estate assets.

Last month, the company announced its first-half results for fiscal year 2023. The company posted a huge jump of 95% in its distributable income of S$56 million on a year-over-year basis. The gross revenues also grew by more than 150% to S$101.7 million. This was mainly due to the acquisition of an office and retail property, JEM, in Singapore.

Analysts are mainly bullish on the company’s retail portfolio, which has a tenant retention rate of 72.4%. The opening of the Chinese economy will also contribute to higher sales for the company’s retail portfolio.

Is Lendlease REIT a Good Buy?

Recently, DBS analyst Geraldine Wong reiterated her Buy rating on the stock. His target price of S$1.0 implies a 48.15% upside on the current price.

Based on two Buy ratings, JYEU stock has a Moderate Buy rating on TipRanks.

The average target price is S$0.89, which is 31.8% higher than the current price.

Conclusion

The return of Chinese tourists to Singapore will offset the current headwinds in the Singapore real estate market.

Based on this backdrop, both U14 and JYEU are well-positioned to grow their revenues and earnings in 2023. Analysts have received Buy ratings on both of these stocks, indicating a potential upside in their share prices.