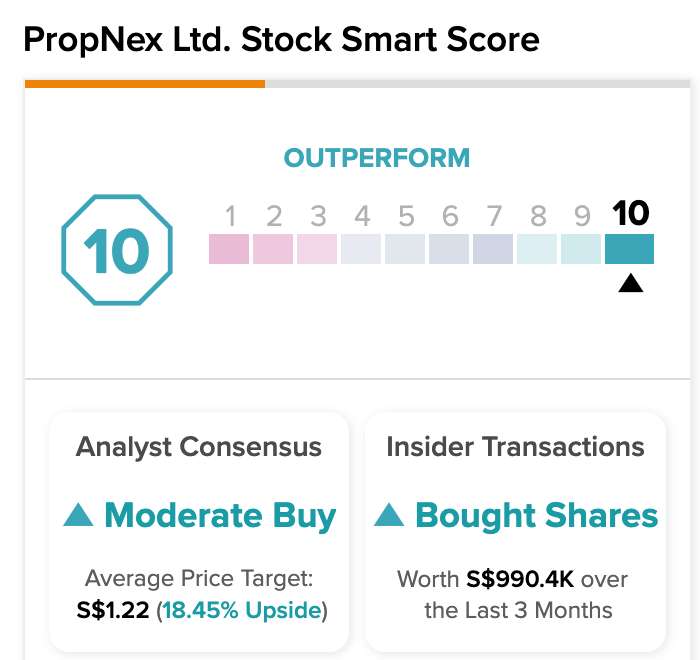

SGX-listed company PropNex Ltd. (SG:OYY) has achieved a score of ‘Perfect 10’ on the TipRanks Smart Score tool. The top score implies their strong potential to surpass market returns over the long term. The recent earnings report from the company primarily influenced this score. Additionally, analysts are also bullish on the stock and have rated it a Moderate Buy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based in Singapore, PropNex is a notable real estate brokerage and consulting firm known for its inclusive online real estate platform, which showcases an extensive array of residential and commercial properties.

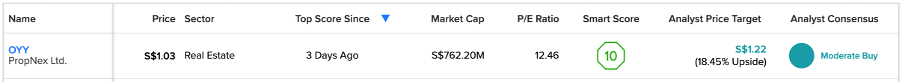

The TipRanks Smart Score tool proves useful in selecting suitable stocks for investors. It evaluates the stock based on a range of factors, including analyst ratings, news, financial bloggers, technical and fundamental analysis, and other relevant criteria. The tool then assigns a score ranging from one to ten to each stock, gauging its potential for market outperformance. Stocks with scores of eight, nine, or ten may hold greater potential for exceeding market returns.

Recent Action

Three days ago, the stock received a Buy rating from UOB Kay Hian analyst Adrian Loh, predicting 19% growth in the share price. On the same day, the stock achieved a score of 10 on TipRanks Smart Score.

Last week, the company announced its Q2 2023 earnings, which drove these favorable movements for the stock. For the first half, the company reported a 22.9% drop in its revenue of S$364.3 million. The net profits also decreased by 18.4% to S$22.1 million, pulled down by reduced commission income. The analysts were expecting this performance amid the challenges in the housing market and price sensitivity among buyers.

Loh maintains a positive outlook on the company’s exposure in the Singapore residential market, given its prominent market share. Additionally, the newly outlined strategies to enter the commercial sector are expected to contribute medium-term support to the company’s earnings.

Technical Analysis

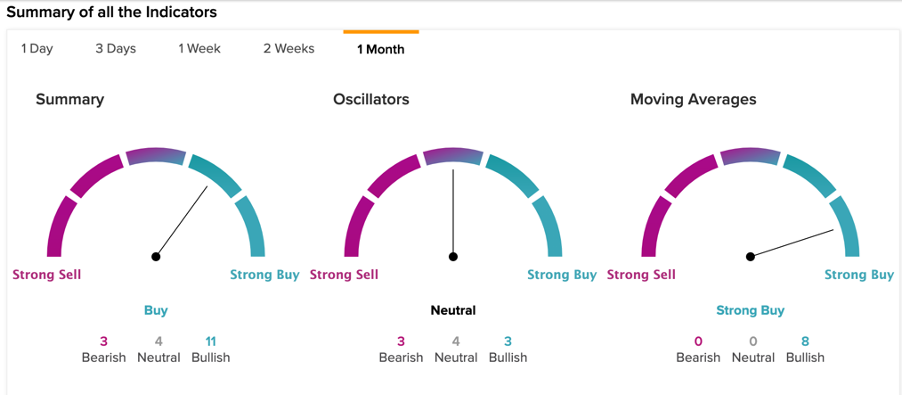

The Smart Score tool also considers the technical analysis of a stock in determining the correct score. According to TipRanks’ technical analysis, OYY stock has a Buy signal for a time period of one month. This conclusion is derived from Buy signals observed from a Neutral signal from oscillators and Strong Buy from the moving averages. The analysis reveals a total of 11 bullish, four neutral, and three bearish signals.

Furthermore, the 50-day simple and 10-day exponential moving averages also indicate a Buy signal for the stock. The stock’s RSI (relative strength index) of 51.11 suggests neutral action for a 1-month period.

Is PropNex a Good Buy?

Based on two Buy recommendations, OYY stock has a Moderate Buy rating on TipRanks. The average target price is S$1.22, which shows a change of almost 18.45% from the current price level.

Conclusion

In the current challenging environment, investors have the option to utilize TipRanks’ Smart Score Tool to choose stocks with a robust potential for surpassing market expectations. Within the Singapore market, PropNex stock has met certain criteria and secured a ‘Perfect 10’ score, presenting a viable option for investors.