SGX-listed Frasers Property Limited (SG:TQ5) yesterday announced an expected decline in some of its investments’ fair value and reduced its profit outlook for the full year. In an update, the company advised its shareholders regarding its fiscal year 2023 and anticipates a significant drop in its attributable profits.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based on its preliminary results for the year, the company is expecting fair-value losses in its investment portfolio, mainly affecting commercial assets in the UK and industrial and logistics properties in Europe. However, these losses don’t affect cash flow and are primarily incurred due to increased capitalization rates.

Nonetheless, the company does not expect these losses to impact the overall trading performance and core earnings as compared to FY22. Frasers expects to deliver profitable numbers in its FY23 annual results scheduled for November 10, 2023.

The Frasers Property share price is trading down by 1.23% today at the time of writing. Year-to-date, the stock has lost around 10% of its value.

Frasers Property is a Singapore-based real estate company with a diverse portfolio, including residential, commercial, and industrial properties. The company invests, develops, and manages assets in around 20 countries worldwide.

Industry Trends

During the difficult macro environment, the Singapore real estate market has emerged resilient, especially in the residential sector. The country has also beaten Hong Kong and currently has the most expensive housing sector in the Asia-Pacific region. The high demand for private properties shows investors’ confidence in the country’s economic prospects.

During its third-quarter results for 2023, Frasers also highlighted the strength of its portfolio but also followed a cautious approach due to higher interest rates and an increase in land supply by the government. In the long term, the company is set to capture further growth opportunities as the travel industry continues to recover and office occupancy stabilizes.

What is the Target Price for Frasers Property Shares?

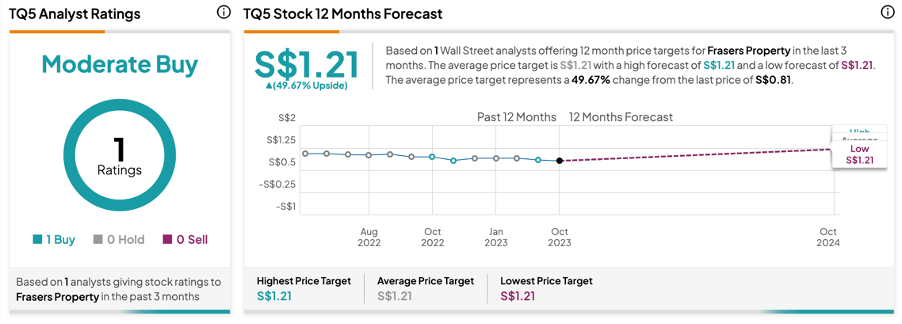

According to TipRanks consensus, TQ5 stock has received a Moderate Buy rating, based on one Buy recommendation from analyst Rachael Tan from DBS. The Frasers Property share price target is set at S$1.21, reflecting an almost 50% increase from the current trading level.