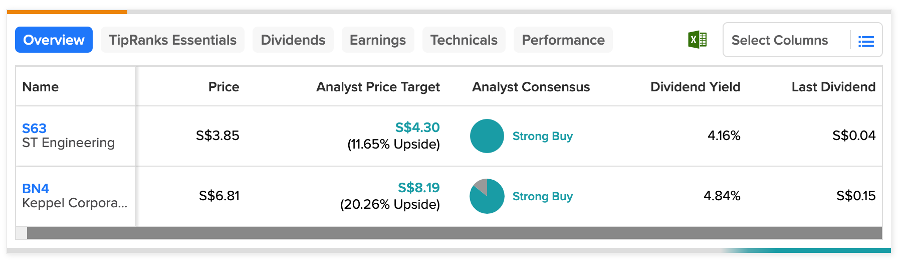

Using the TipRanks database, we have shortlisted SGX-listed Singapore Technologies Engineering Limited, or ST Engineering (SG:S63), and Keppel Corporation Limited (SG:BN4) shares, which offer attractive dividend yields. Both these stocks boast dividend yields exceeding 4%, significantly surpassing the average yields within their respective industries.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Moreover, these stocks have received Strong Buy ratings from analysts.

TipRanks offers users a variety of tools designed to help them choose dividend stocks that match their criteria. These resources, including Top Dividend Stocks, Dividend Calculator, and Dividend Calendar, among others, simplify the task of screening and picking stocks within different markets.

Let’s take a look at these two stocks in detail.

ST Engineering Dividend History

Based in Singapore, ST Engineering is a global conglomerate specializing in technology, defense, and engineering services, serving clients in more than 100 countries across the globe.

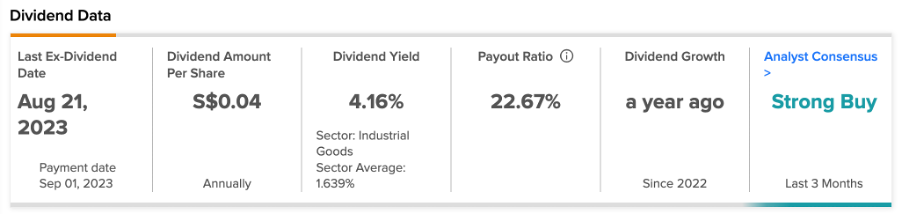

The company has a stable track record of distributing dividends to its shareholders. Since 2017, the company has maintained an annual dividend payment of S$0.15 per share. In 2022, the company increased its yearly dividend from S$0.15 to S$0.16, amounting to S$0.04 per quarter. So far, in 2023, the company has announced a dividend of S$0.08, distributed in two equal installments of S$0.04 each, with the most recent payment made in August 2023.

The company’s strong order book, currently valued at S$23 billion, is noteworthy and suggests a favorable path for revenue growth. It also provides scope for a dividend hike. ST Engineering has also established an ambitious revenue target of S$11 billion by 2026. The company’s strategic move to divest its non-core business divisions and prioritize sectors like aircraft maintenance is in line with its revenue objective and showcases a prudent strategy.

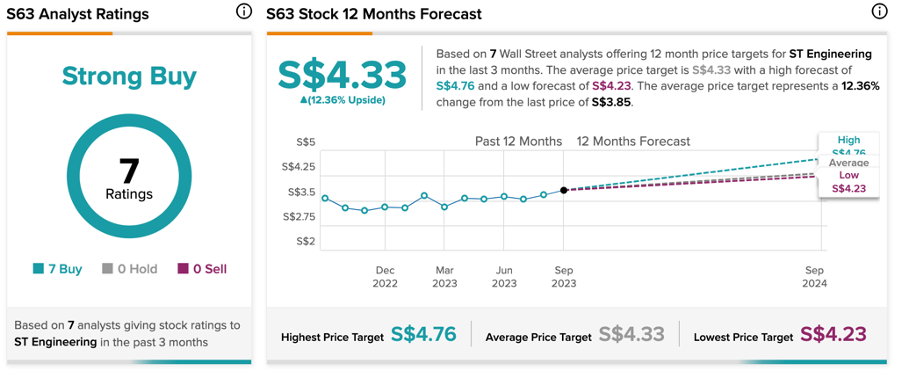

What is the Target Price for S63 Shares?

According to TipRanks, S63 stock has received a Strong Buy rating based on Buy recommendations from all seven analysts covering the stock. The ST Engineering share price forecast is S$4.33, with a high forecast of S$4.76 and a low forecast of S$4.23. The price target implies an upside of 12.3% on the current trading levels.

YTD, the shares have gained almost 18% in trading.

What is the Interim Dividend for Keppel in 2023?

Keppel Corp. is a diversified group engaged in various industries, including marine, infrastructure, energy, asset management, and urban development. The Keppel share price started 2023 with robust performance, posting a YTD gain of 51%.

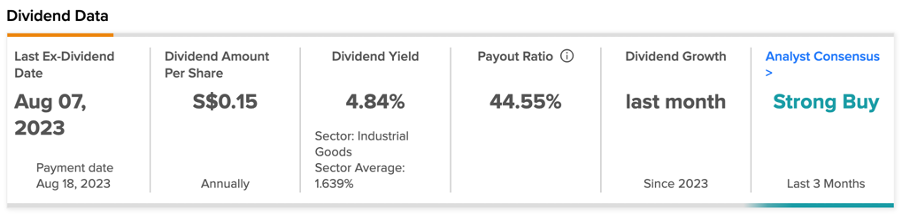

The company’s dividend yield of 4.84% comfortably surpasses the sector average of 1.64%. In August, the company paid its interim dividend for 2023 of S$0.15 per share, which was higher than analysts’ expectations. This was the same as the interim dividend of S$0.15 paid in the first half of 2022.

In its first-half earnings for 2023, the company posted a record net profit of S$3.6 billion, the highest ever in its history. Along with its results, the company announced a special dividend (in-specie) under its capital management initiatives to commemorate its 55th anniversary. For every five Keppel Corporation shares owned, the shareholders would be entitled to one unit of Keppel REIT, subject to approval at the Extraordinary General Meeting to be held later this year. Overall, Keppel provides shareholders with an opportunity to possess an investment offering an attractive dividend yield.

Is Keppel a Buy or Sell?

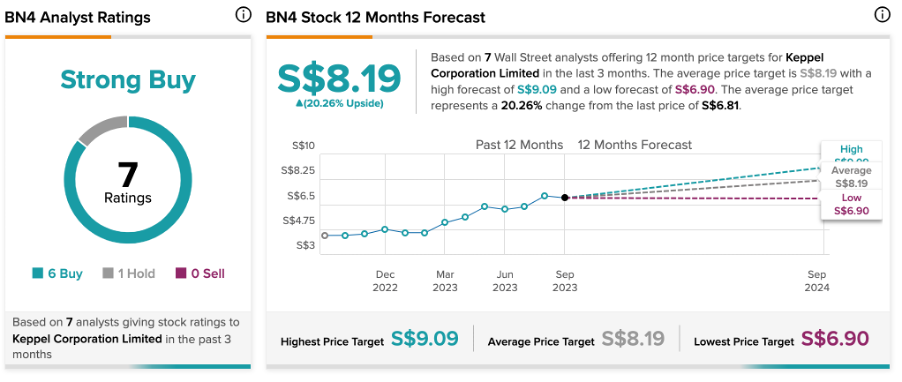

BN4 stock has received a Strong Buy rating on TipRanks, backed by six Buy and one Hold recommendations. The Keppel share price prediction is S$8.19, which is 20.3% higher than the current price level.

Conclusion

Beating their respective sector averages, ST Engineering and Keppel offer appealing returns for income-oriented investors. The Buy ratings given by analysts add to the attractiveness of these stocks.