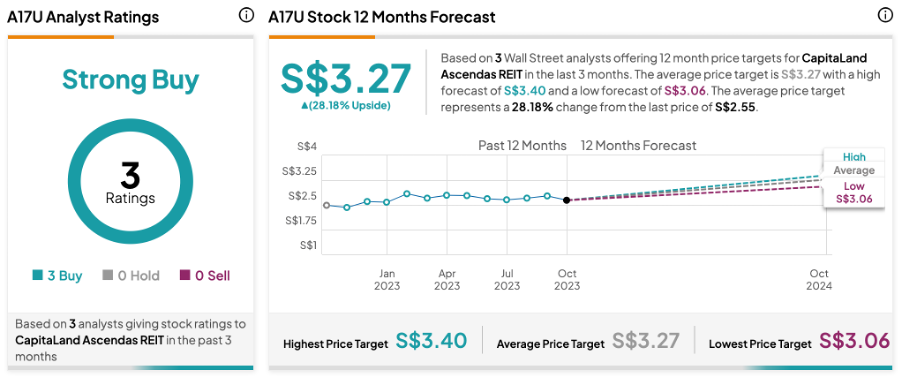

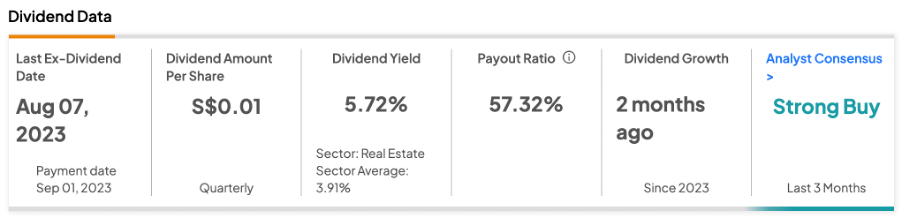

SGX-listed CapitaLand Ascendas REIT Management Limited (SG:A17U) offers investors an attractive opportunity to diversify their portfolios with dividend income. CapitaLand Ascendas REIT currently offers a dividend yield of 5.72%, surpassing the industry’s average rate of 4%. In terms of capital appreciation, A17U stock has been rated as a Strong Buy with a potential upside of 28% in the share price.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CapitaLand Ascendas REIT is the oldest and largest listed industrial real estate investment trust in Singapore. It holds a diverse portfolio of 230 properties located in various regions, including Singapore, the U.S., Australia, the UK, and Europe. The company’s portfolio is spread across three segments: Business Space and Life Sciences, Logistics, and Industrial and Data Centers.

More on CapitaLand Ascendas’ Dividends

The company is committed to providing its unitholders with consistent dividends and long-term capital stability. Distributions are typically made twice a year, in March and September.

The company issued an advance DPU (distribution per unit) of S$0.06141 for the period from January 1 to May 24, 2023. This amount was paid to unitholders on June 26, 2023. In its first-half results for 2023, the company declared a DPU of S$0.07719, which was 2% down compared to the same period in 2022. The company’s total amount available for distribution declined by 1% to S$327.5 million due to higher interest expenses amid the growing interest rates in the economy.

On the brighter side, CapitaLand Ascendas’ net property income increased by 6.7% year-over-year, driven by an improved occupancy rate, rental growth in renewed leases, and acquisitions. As of June 30, 2023, the company maintained a high portfolio occupancy rate of 94.4%. Looking ahead, the company has projects worth S$776.5 million in progress that are slated for completion between the second half of 2023 and the second quarter of 2026.

Is Ascendas REIT a Good Buy?

According to TipRanks’ rating consensus, A17U stock has received a Strong Buy rating backed by all Buy recommendations from three analysts. The CapitaLand Ascendas share price target is S$3.27, which is 28.2% higher than the current price level.