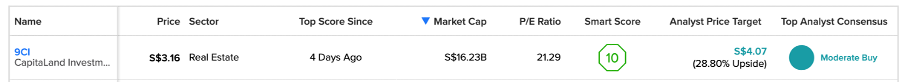

SGX-listed CapitaLand Investment Limited (SG:9CI) achieved a “Perfect 10” on the TipRanks Smart Score tool. The list comprises stocks with a higher likelihood of surpassing the benchmark index. CapitaLand stock secured a spot on the list just six days ago, signaling an improved probability of the stock outperforming market averages. Overall, analysts have rated the stock as a Moderate Buy and foresee a potential 29% increase in its share price.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CapitaLand operates as a real estate investment manager, managing a portfolio of assets spanning 40 countries with a strong presence in Asian markets.

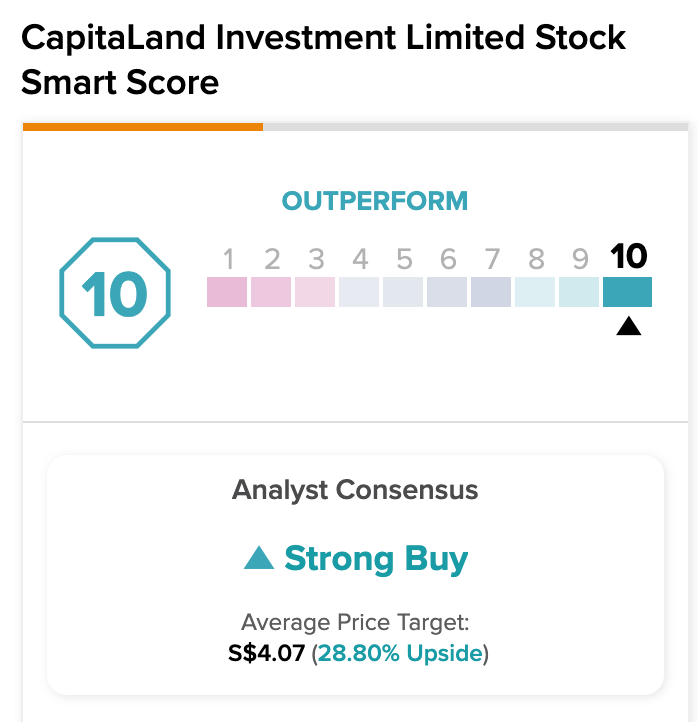

The TipRanks Smart Score, which is now available in nine markets, is an appropriate tool for investors researching long-term opportunities. This tool assigns stocks a rating from one to ten and offers insights into their potential to outperform overall market returns. This score is determined by evaluating eight distinct factors, including hedge fund activities, fundamental analysis, analyst ratings, and more.

Let’s take a look at more details.

Strong Business Recovery

The inclusion of CapitaLand Investment in the “Perfect 10” Smart Score list shouldn’t come as a significant surprise. In its Q2 2023 earnings, the company’s lodging business witnessed a strong recovery and posted a jump of 32% in its revenue per available unit to S$87. The FRE (fee-related revenue) during H124 increased by 35% to S$159 million. The company is aiming to grow its lodging business’s FRE to S$500 million in the next five years.

Bullish Stance from Analysts

Analysts are bullish on the company’s rebounding lodging business, driven by improved travel and tourism activities. Additionally, the company is making strong progress in expanding its asset portfolio.

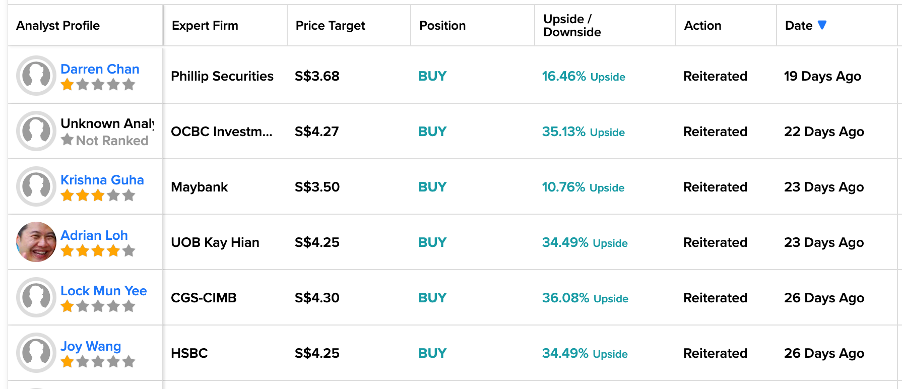

Over the course of the last month, many analysts have reiterated their Buy ratings on the stock, driven by the impressive recovery in its earnings numbers.

Most recently, analyst Darren Chan from Phillip Securities confirmed his Buy rating on the stock at a price target of S$3.68, implying a growth of 16.4%.

Among these analysts, CGS-CIMB’s analyst Lock Mun Yee has the highest price target on the stock at S$4.3. This is 36.08% higher than the current trading level.

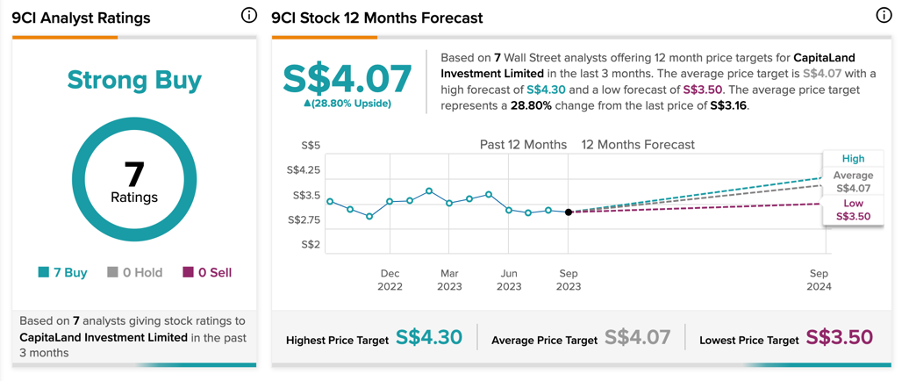

What is the target price for 9CI?

According to TipRanks’ analyst consensus, 9CI stock has received a Strong Buy rating. The stock has all Buy recommendations from seven analysts.

The CapitaLand Investment share price forecast is S$4.07, which is 28.8% higher than the current price level.

Ending Notes

Securing a “Perfect 10” on the Smart Score list and receiving positive ratings from analysts bolster the investment argument for CapitaLand Investment.