SGX-listed Sembcorp Industries (SG:F34) yesterday received a Buy rating confirmation from analysts, suggesting more upside potential in the share price. The ratings were mainly driven by the solid numbers posted in its recently reported earnings last week. Overall, the stock has a Strong Buy rating on TipRanks.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Over the last 12 months, the company’s stock has experienced a robust surge, recording a 98% increase in value, of which 64% has been achieved in the last six-month period. The impressive operational performance of the company has been the driving force behind this substantial growth in its share price.

Sembcorp is a sustainable solutions company focused on energy and urban development. The company’s objective is to transition its portfolio towards a more environmentally friendly future and establish itself as a foremost provider of sustainable solutions.

Strong Number Game

The company showcased a strong performance in its half-yearly earnings announcement last week. During the period, the company posted a net profit (before exceptional items) of S$602 million, which was 55% higher than the last year’s number for the same period. Adjusted earnings also grew by 50% to S$1.1 billion. The group’s turnover was down from S$3.9 billion in first half of 2022 to S$3.7 billion in this results.

The company’s renewables segment appears poised to emerge as its upcoming source of growth. Not only did it stand out as the sole division within the group to register a year-on-year increase in revenue, but the net profit for this segment also experienced a significant surge of 54% compared to the previous year, amounting to S$117 million. The company’s conventional energy segment also contributed to the growth, driven by elevated power prices within the Singapore electricity market.

Sembcorp expects its earnings for the full year to surpass those of 2022.

Analysts are Optimistic

Following the positive set of results, analysts at Citigroup and HSBC have maintained their Buy recommendations while adjusting their target prices upward.

Yesterday, Rahul Bhatia from HSBC raised his price target on the stock from S$7.06 to S$7.11, while confirming the Buy recommendation. The price is 16.7% above the current trading levels.

Similarly, Citi analyst James Osman remains bullish on further growth in the share price and increased his price target from S$5.98 to S$7.13. This implies a growth of 17% in the share price. Osman stated that the company’s net debt has shown improvement, reaching a ratio of 3.3x by the end of the first half of FY2023, with 71% of its borrowing at fixed rates. He is also bullish on the company’s renewables segment, where it has further potential to increase its energy capacity in India and China. He believes the upcoming investor day in November could drive the share price higher in the near term.

What is the Price Target for Sembcorp Industries 2023?

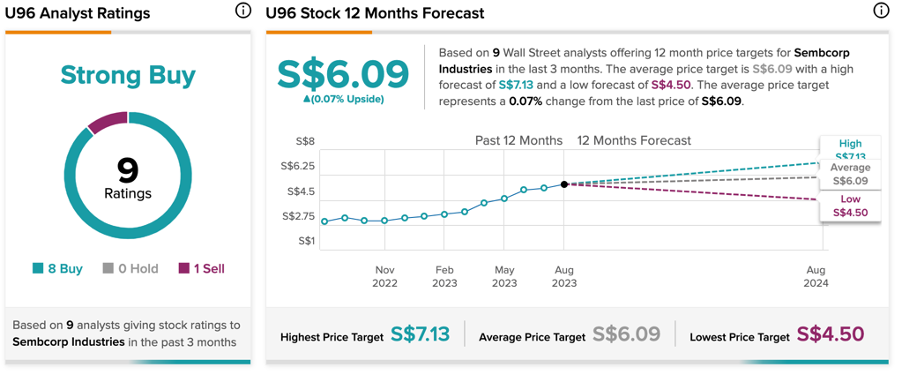

U96 stock has a Strong Buy rating on TipRanks, backed by all eight Buy and one Sell recommendations. The average target price is S$6.09, which is similar to the current trading level.