UK-based property agent Savills PLC (GB:SVS) and house builder Persimmon PLC (GB:PSN) reported lower Q2 profits amid the current weakness in the housing sector.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Savills’ shares tumbled by over 10% on Thursday over the disappointing numbers. On the other hand, Persimmon shares ended the day with a gain of 2.5% despite lower numbers, indicating that investors were anticipating this performance.

These companies have also announced a decrease in their profits, like numerous other firms in the housing industry, as purchasers experience the impact of elevated mortgage expenses. Additionally, home prices continue their downward trend due to suppressed demand. In July 2023, UK home prices experienced a drop of 2.4% on a year-over-year basis, marking the fourth consecutive month of price drops.

Let’s take a look at the numbers.

Savills: Is the Worst Over Now?

Savills is a UK-based real estate company that provides a wide range of services such as advisory, asset management, renting, finance, valuation, and many more.

The company reported a drop of more than 80% in its pre-tax profits of £6 million in its half-year earnings for 2023. This was down from the profits of £50.4 million generated in the same period a year ago. The company’s revenue also decreased by 2.5% to £1.01 billion. The lower numbers were mainly pulled down by its transaction advisory business, which saw a 20% decline in its revenue. The company also blamed “obvious challenges associated with inflation” for its declining profits.

On the positive side for investors, the company raised its interim dividend from 6.6p in the last year to 6.9p in H1 2023.

The company acknowledges the emergence of favorable recovery indications in specific markets; however, due to uncertainty regarding timing, offering precise forward guidance remains challenging. It also expects that the recovery in China will remain slow for the rest of 2023. Nevertheless, there is anticipation of ongoing volume improvement in the second half and in 2024.

Persimmon Results: Could This be a Long-Term Opportunity?

Persimmon is among the leading real estate construction companies in the UK, building residential houses and offering maintenance services.

The company’s revenues took a big hit and fell by almost 30% to £1.19 billion. The pre-tax profits also dropped to £151 million from £440 million a year ago. This was an outcome as the company completed 4,259 homes during this period, which was lower than the 6,642 built in the first half of 2022. The company still remains confident in completing 9,000 homes in the full year, as targeted earlier.

Persimmon’s recent results have revealed significant declines, which affected first-time buyers, who constitute the majority of Persimmon’s customers. Analysts are not so hopeful about the short-term outlook of the company. However, there is reason for encouragement in the company’s prospective sales outlook. Forward private sales, comprising higher-value properties, have surged by 83% since January. This boost is expected to provide a measure of support for the company’s revenue, further aided by a modest increase in private average selling prices.

What is the Target Price for Persimmon Stock?

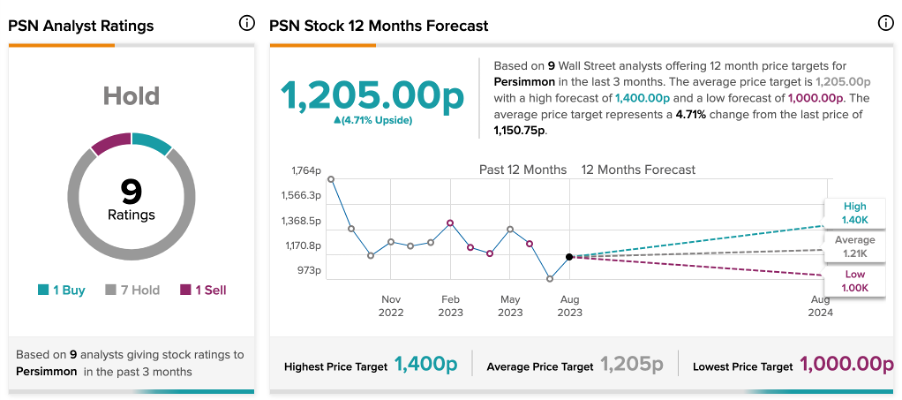

PSN stock has a Hold rating on TipRanks, based on a total of nine recommendations from analysts. The average target price is 1,205p, which is 4.7% above the current trading price.

Conclusion

Amid the challenging circumstances within the UK housing sector, these companies have delivered performances that were more or less expected by both the market and analysts. Nonetheless, these companies are witnessing some signs of stability and believe their performances will be resilient in the second half of the year.