The share price of the German company Sartorius AG (DE:SRT) fell around 6% today after the company trimmed its full-year forecast for revenue and earnings due to disappointing sales. The revenue for the full year is expected to fall by 17%, which was earlier projected as a decline of low to mid-teen percent. The company now anticipates an underlying EBITDA margin slightly above 28%, revising its previous forecast of around 30%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Sartorius share price was down by 5.3% at the time of writing today, reflecting the sentiment of unhappy investors. In the last 12 months, the stock has been trading down by 24% as the company struggles with lower orders and reduced demand for pandemic-related products.

Sartorius manufactures and provides equipment to the pharmaceutical industry and laboratories in around 60 locations globally.

Preliminary Results for Nine Months

According to its preliminary numbers, the company posted a 16% decline in its revenue of €2.5 billion for the first nine months of FY23. The underlying EBITDA margin also decreased to 29%, down from 33.8% a year ago.

Among its divisions, Bioprocess Solutions posted a decline of 18% in its revenue for the nine months, mainly due to inventory cutbacks after the pandemic and the closure of business in Russia, among other reasons. The Lap Products & Services segment’s sales revenue was down by 11% to €533 million as the big pharmaceutical players cut down their spending on equipment.

Is Sartorius Stock a Buy or Sell?

Overall, pharmaceutical companies have warned of lower profits in 2023 as the high demand observed during the pandemic period has now faded. Analysts feel the stocks are expected to be volatile in the short term until sales stabilize. Nonetheless, they are confident in the long-term aspects of the industry. Sartorius also confirmed its medium- and long-term market outlook and anticipates profitable growth for the year 2024.

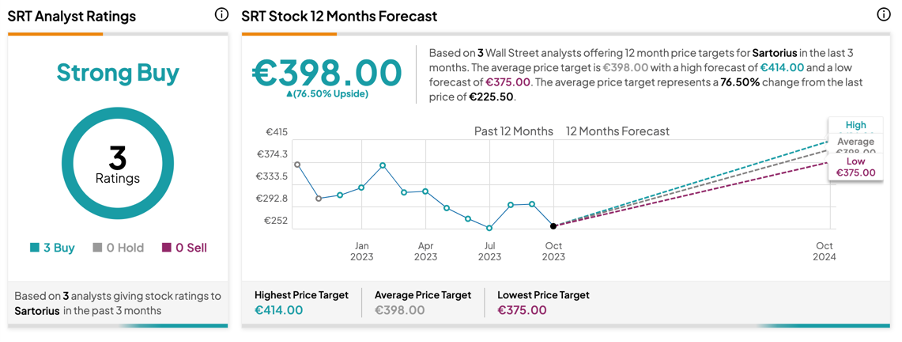

As per the consensus among analysts on TipRanks, SRT stock has been assigned a Strong Buy rating, backed by all three Buy recommendations. The Sartorius share price target is €398, which signifies a potential change of 76.5% from the current level.