German software company SAP SE (DE:SAP) is set to pay more than $220 million (£172 million) in fines to U.S. regulators to clear bribery charges. The company was accused of bribing government officials in South Africa and Indonesia to gain government contracts beginning in 2013 and thereon.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The U.S. attorney overseeing the case stated that SAP cooperated with the American regulators’ long-standing probe and has “accepted responsibility for corrupt practices.” Following the news, SAP shares were up over 1% in early morning trade today.

SAP is a multinational company developing enterprise software for managing business operations and customer relations. SAP shares have gained 35.5% in the past year.

Details About the Settlement

SAP has entered into a three-year deferred prosecution agreement with the U.S. Securities and Exchange Commission (SEC) and the Justice Department to settle violations under the US Foreign Corrupt Practices Act (FCPA). The company is charged on two counts – conspiracy to violate the anti-bribery as well as books and records provisions of the FCPA. As per the agreement, SAP will pay a criminal fine of $118.8 million and administrative forfeiture of about $103.4 million.

SAP is also accused of similar manipulative practices in Malawi, Kenya, Tanzania, Ghana, and Azerbaijan. Regulators alleged that SAP’s officers often routed gifts, cash, political donations, paid travel, and other benefits to government officials via third-party consultants. Importantly, the U.S. authorities stated that charges against SAP would be cleared only after three years of complying with the agreement.

On its part, SAP is happy that the bribing charges will be settled. The company is said to have stopped all relations with the parties involved and fired the concerned officials more than five years back. Meanwhile, it has amped up its global compliance program and strengthened internal controls to ensure no such incidents occur again.

Is SAP a Good Stock to Buy Now?

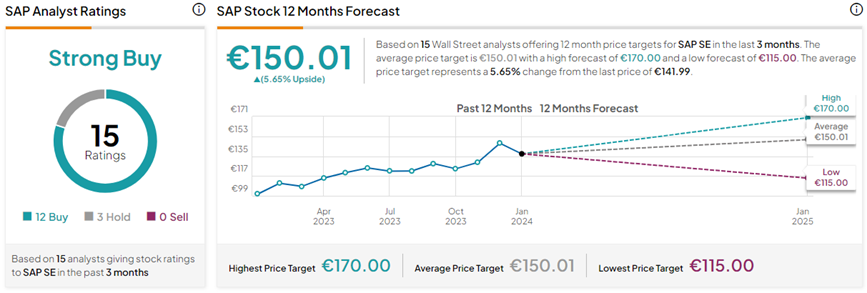

On January 10, UBS analyst Michael Briest maintained a Buy rating on SAP stock with a price target of €168.00 (18.3% upside).

With 12 Buys and three Hold ratings, SAP stock has a Strong Buy consensus rating on TipRanks. The SAP SE share price forecast of €150.01 implies 5.7% upside potential from current levels.