Italian energy group Saipem SpA (IT:SPM) stock yesterday received a new Buy rating from Morgan Stanley, which considers the stock its top pick in the sector. The broker initiated a new Buy rating on the stock and predicted growth of over 40% in the share price. Overall, the stock already has a Strong Buy rating on TipRanks.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The shares gained around 5% yesterday after the favorable comments from the analyst at Morgan Stanley. YTD, the stock has experienced an increase of 27% in trading.

Saipem operates as a contractor in the oil and gas industry, providing services like construction, drilling, engineering, project management, and more.

Analyst’s Bullish Opinion

Yesterday, analyst Sasikanth Chilukuru from Morgan Stanley initiated his coverage of the stock with a Buy rating. He has set a price target of €2.15, implying an upside potential of 43% from its current trading level. Chilukuru mainly covers energy companies in various markets like the U.S., UK, France, Italy, Spain, and Germany.

Overall, Chilukuru is bullish on the European energy services companies, considering the high demand for energy projects, the upcoming pipeline of new tenders, and improved margins from price hikes. He also indicated Saipem as his favorite in the sector. Morgan Stanley also stated that Saipem has the advantage of long-cycle projects, which could help further strengthen its margins.

Chilukuru expects the company to deliver EBITDA growth of around 50% between 2023 and 2025. He also believes the company will generate healthy cash during that time and could “potentially be a positive factor for the introduction of dividend payments.”

11 days ago, Berenberg Bank analyst Richard Dawson also confirmed his Buy rating on the stock, predicting a solid growth rate of 93% in the share price. He also raised his price target from €1.9 to €2.9.

Is Saipem a Good Investment?

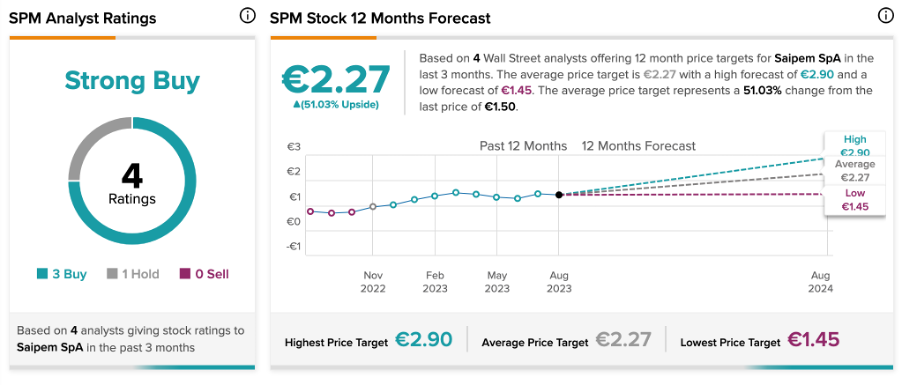

According to TipRanks, SPM stock has a Strong Buy rating based on three Buy and one Hold recommendations from analysts. The average price target of €2.27 offers a solid growth potential of 51.18% from the current trading level.