The share price of the FTSE 100-listed Sage Group PLC (GB:SGE) soared yesterday after its FY23 results. The company reported a strong year with revenue growth, a dividend boost, and a share buyback program. The total underlying revenue increased by 10% to £2.18 billion, driven mainly by 25% revenue growth in its Business Cloud, reaching £1.63 billion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Additionally, the company also reported strong growth in underlying operating profit, marking an 18% increase to reach £456 million. The profitability was fuelled by a 140 bps increase in margin to 20.9%, due to operational efficiencies achieved by the company. The EBITDA experienced a robust uptick of 16%, reaching £553 million, accompanied by a 120 bps rise in margin to 25.3%.

Post-results, the Sage share price surged by 13.5% on Wednesday, claiming the top spot on the FTSE 100 index. The stock achieved a milestone by surpassing the 1100p mark, contributing to a year-to-date gain of over 50%.

Sage Group is a UK-based software company, offering solutions to multiple industries like construction, e-commerce, healthcare, hospitality, etc.

Double Delight for Shareholders: Dividend and Share Buyback

In light of the strong numbers during the year, the company rewarded its shareholders with a double bonanza. Sage declared a final dividend of 12.75p per share, raising its full-year dividend to 19.3p, reflecting a 5% growth over last year’s payment.

Additionally, the company revealed a share buyback program of up to £350 million, aligning with the company’s robust financial position and strong cash generation. The company showcased robust cash conversion at 116%, highlighting the growth in subscription revenue and effective management of working capital.

In terms of outlook, the company anticipates organic total revenue growth in FY24 to align closely with that of FY23. Additionally, operating margins are projected to show an upward trend in FY24 and beyond.

Are Sage Shares a Good Buy?

Yesterday, analyst Charles Brennan reiterated his Buy rating on the stock, predicting an upside of 16% in the share price. We expect that more analysts will confirm their ratings following the release of the results.

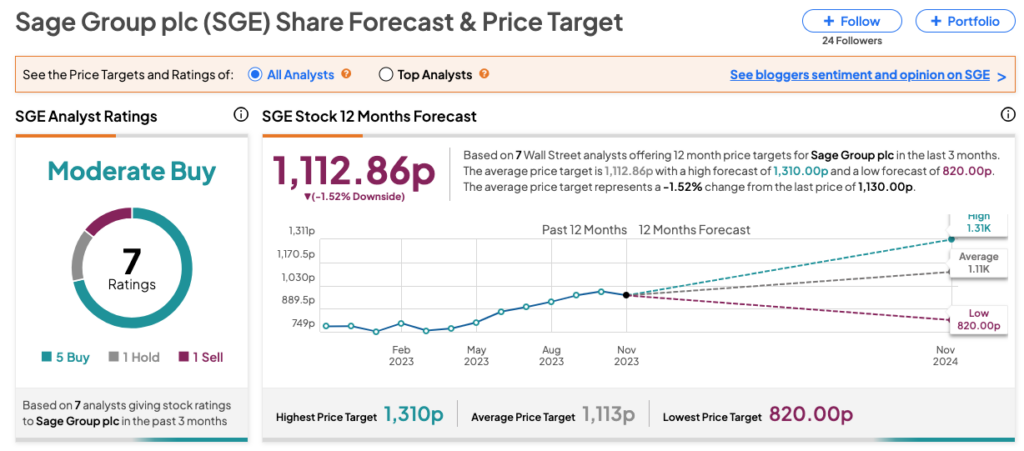

As per the consensus among analysts on TipRanks, SGE stock has been assigned a Moderate Buy rating. The company’s ratings consist of all five Buy, one Hold, and one Sell recommendations. The share price target is1,112.8p, which is around 2% below the current share price.