Spanish banks Banco de Sabadell (ES:SAB) and Unicaja Banco SA (ES:UNI) will release their annual results for 2022 over the next few days. The analysts remain confident about another positive quarter from the Spanish banks. The rising interest rates help the banks earn more net interest income (NII). As the Spanish banks have a higher volume of variable-rate loans in their portfolio, they will post higher NII as compared to their European counterparts.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Here, we have used the TipRanks Earnings Calendar for Spain to find out about the forthcoming earnings of these banks. With this tool, investors can have systematic and updated information in their hands regarding the companies that are about to announce results.

Let’s have a look at them in detail.

Banco de Sabadell, S.A.

Banco de Sabadell is among the top five banks in Spain. The bank offers personal and business banking services.

Banco Sabadell will report its annual results for 2022 on January 26, 2023. The company’s performance in the previous quarters of 2022 has been solid, which is clearly reflected in its share price as well. In the last year, the stock price has gained 62%.

The third quarter results of the bank were termed as one of the best after 2015. The analysts expect this trend to continue for the bank, with a 47.2% jump in net income at €784.5 million in 2022.

The analysts also see Banco Sabadell as the biggest beneficiary of higher interest rates as compared to other Spanish banks. The bank also raised its net interest income guidance for the full year, expecting more than 10% growth. The analysts, however, forecast NII growth of 8.2% in 2022.

For the fourth quarter, the consensus EPS forecast on TipRanks is €0.02, which is lower than the previous year’s EPS of €0.03.

Banco de Sabadell Share Price Forecast

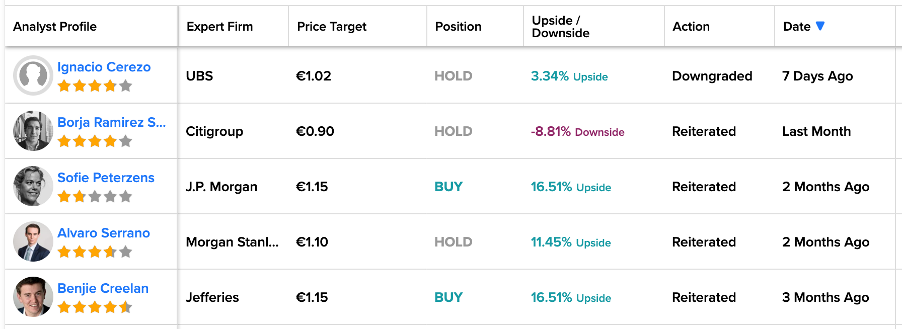

In terms of share price growth, analysts have mixed ratings on the stock. Morgan Stanley and J.P. Morgan have Buy ratings and expect an upside in the share price. Citigroup, on the other hand, has a Sell rating with a downside of around 8%.

The SAB average target price is €1.03, which is 4.36% higher than the current trading price. The stock has a Moderate Buy rating on TipRanks.

Unicaja Banco SA

Unicaja Banco is the fifth-largest bank in Spain and provides banking services to around four million customers.

Unicaja will report its full-year results for 2022 on January 31, 2023. On TipRanks, the consensus EPS forecast is €0.04 for the fourth quarter of 2022, as compared to -€0.01 in the same quarter of 2021.

Unicaja is less diversified in terms of its business operations as compared to its banking peers. The bank has been working towards improving its asset base in its asset management and insurance segments, where it can utilize its cross-selling skills. The bank’s profitability was also below that of its peers, but the higher interest rates have pushed the profits higher.

During the first nine months of 2022, the bank posted a 67.1% increase in its net income of €260 million. This was mainly driven by its retail business and fee income. Moving forward, the analyst expects double-digit growth in its net interest margin.

However, the analysts are not so bullish on the share price growth, considering the good performance of the stock since the beginning of the year.

Analyst Ignacio Cerezo from UBS has downgraded his rating from Buy to Hold on the stock ahead of its earnings. He has increased his target price from €1.25 to €1.3.

Unicaja Banco Share Price Target

According to TipRanks’ analyst consensus, Unicaja stock has a Hold rating. The rating is based on one Buy, one Hold, and one Sell recommendation.

The UNI average price forecast is €1.17, which is 2.73% lower than the current price.

Conclusion

The rising inflation followed by interest rate hikes has boosted the net interest income of banks in Spain. Analysts are expecting higher net income numbers for these banks for the full year of 2022. The analysts, however, don’t see any major upside to the share prices in the near future.