The UK-based S4 Capital PLC’s (GB:SFOR) shares were hit hard yesterday after the company reported a 15.4% decline in its Q3 net revenues. This decline is attributed to reduced activity in content, data, and digital media. S4 Capital further stated that it anticipates a decline in like-for-like revenue for the full year 2023 compared to the previous year. The company also downgraded its operational EBITDA margin to 10%-11% from the previous forecast of 12% to 13.5%.

This is the company’s third profit warning in the last few months, indicating economic difficulties and leading its clients to reduce their spending.

The share price went down by 13% on Thursday, leading to an almost 70% drop so far in 2023.

S4 Capital is a media company specializing in digital advertising and marketing. It was founded and is currently led by industry veteran Sir Martin Sorrell.

Third Quarter Trading Update

In the third quarter, the company reported net revenues of £211.5 million, compared to £250 million a year ago. Among its segments, revenues from Content and Digital Media declined by 20.4% and 14.2%, respectively.

Among regions, the company’s biggest market, the Americas, is experiencing the effects of decreased activity and currency fluctuations. In Q3, net revenue in this region declined by 14.5% to £167.6 million, with a like-for-like decrease of 8.3%.

Moving ahead, despite the ongoing challenges, the company anticipates potential benefits in full-year results from Q4 figures, driven by seasonal patterns and anticipated business from clients.

The company will publish its annual report for 2023 in March 2024.

What is the Target Price for S4 Capital?

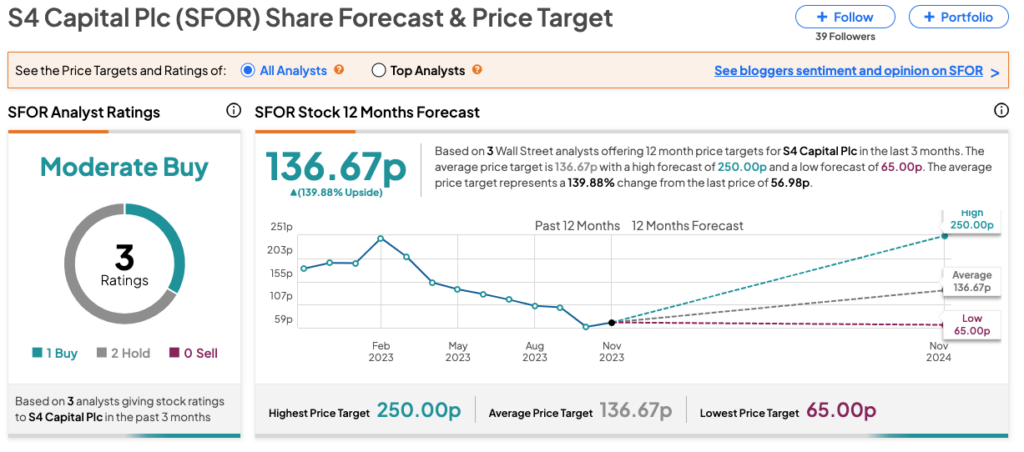

According to TipRanks, SFOR stock has been assigned a Moderate Buy rating based on one Buy and two Hold recommendations from analysts. The S4 Capital share price target is 136.7p, which represents a change of 140% from the current trading level.