Irish low-cost carrier Ryanair Holdings Plc (GB:0A2U) reported a 3% year-over-year uptick in its January traffic to 12.2 million, despite the ongoing row with online travel agents (OTAs). In early December, several OTAs stopped listing Ryanair’s flights on their sites. The airline accused the OTAs of overcharging customers with hidden costs.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ryanair’s Mixed Update

While Ryanair managed to increase its January traffic, its load factor declined to 89% from 91% in the same month last year. The load factor indicates how much of an airline’s capacity has been utilized.

The airline blamed the short-term decline in load factor on the removal of its flights from most OTA “Pirate” websites. That said, Ryanair expects the impact of the OTA ban on its bookings to be temporary. In fact, several bigger OTAs have approached Ryanair for direct collaboration, with the career already reaching agreements with loveholidays.com and Kiwi.com.

Meanwhile, Ryanair disclosed that it operated 71,700 flights last month, with over 950 flights cancelled due to the Israel-Gaza conflict.

Last week, Ryanair lowered its full-year profit guidance due to increased fuel and staffing costs and the OTA ban. The airline also expects the delay in deliveries of Boeing (NYSE:BA) aircraft to weigh on its growth.

Aside from Ryanair, rival Wizz Air Holdings (GB:WIZZ) also announced its January metrics. Wizz Air witnessed a 14.2% jump in its January traffic. However, the load factor declined 4.1 percentage points to 82% due to the conflict in the Middle East and an issue with Pratt & Whitney engines on Wizz Air’s aircraft.

Wizz shares rallied about 8% today as of writing, while Ryanair shares were up more than 1%.

Are Ryanair Shares a Good Buy?

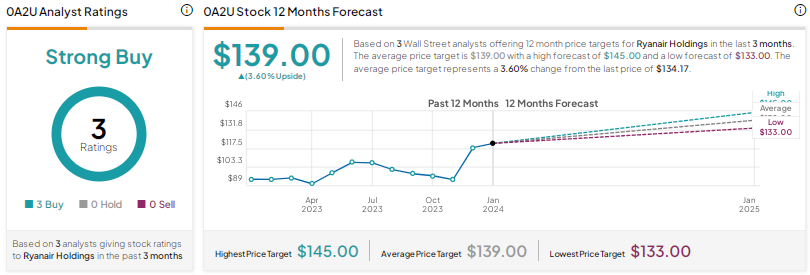

Analysts have a Strong Buy consensus rating on 0A2U stock based on three unanimous Buys. The Ryanair Holdings share price target of $139 implies about 4% upside potential.