European airlines Ryanair Holdings (NASDAQ:RYAAY) (GB:0A2U) (DE:RY4D) and British telecommunications company Vodafone Group PLC (GB:VOD) announced their first-quarter earnings for the fiscal year 2024.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Despite a huge surge in quarterly profits, Ryanair kept a cautious eye on passenger demand for the remaining year. While Vodafone posted higher top-line growth in its trading update and also announced a new CFO for the company to drive higher earnings from Europe.

The TipRanks Earnings Calendar tool, which is available for nine different markets, provides an updated list of companies that have recently disclosed their earnings along with those scheduled to announce their results in the near future. Investors can take advantage of this resource to conduct further research on these stocks, thereby enhancing their decision-making process.

Let’s explore this further.

Vodafone Group PLC

Vodafone announced its trading update for the first quarter of 2024 today. The group’s total service revenue grew by 3.7% to €10.7 billion, driven by higher prices in the UK along with improved performances in Germany, Italy, and Spain. The UK’s service revenue grew by 5.7%, backed by higher prices and a larger customer base.

The company also announced a new CFO, Luka Mucic, who will replace Margherita Della Valle, who was appointed as Group CEO in May 2023. Valle was appointed to the top job to streamline operations and address issues in its key market, Germany. Post-update, Valle commented, “We’ve taken the first steps, but of course, we have much more still to do.”

Are Vodafone Shares a Good Buy?

According to TipRanks’ analyst consensus, VOD stock has a Moderate Buy rating. The stock has six Buy versus six Hold recommendations.

The average share price forecast is 105.83p, which is 38.5% higher than the current price level.

Ryanair Holdings

Ryanair posted its first-quarter earnings for 2023 today with a profit of €663 million, which was €170 million higher than last year. The company reported an EPS of €0.58 per share.

In the 12 weeks leading up to the end of June, more than 50 million individuals traveled with the company, positioning it to maintain its status as Europe’s leading airline in terms of passenger numbers. The revenue for the quarter was up by 40% to €3.65 billion.

Despite higher growth, the company is cautious regarding travel demand moving forward in the year. It also revised its passenger growth forecast downward, attributing the change to Boeing delivery delays.

Ryanair Share Price Forecast

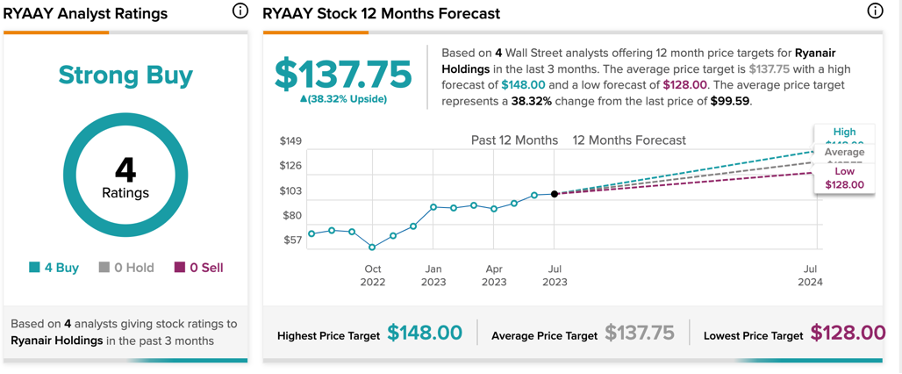

RYAAY stock has a Strong Buy rating on TipRanks based on all four Buy recommendations.

The average target price is $137.75, which implies an upside of 38.3% on the current trading price.

Ending Thoughts

Both of these stocks are viewed positively by analysts, with a bullish outlook. Ryanair’s stock is expected to experience a potential share price growth of around 38%, backed by a Strong Buy rating. On the other hand, Vodafone presents an even higher upside potential of 38% with a Moderate Buy rating.