The last few years have been difficult for both telecommunications giant Vodafone (GB:VOD) and manufacturing company Rolls-Royce Holdings (GB:RR) on the stock market. Vodafone’s stock has lost almost 30%, while Rolls-Royce’s stock has lost 56% in the last three years.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

When compared to each other, Rolls-Royce is better placed on a long-term horizon. With the airlines now reporting higher passengers, the company is looking at better maintenance numbers, which contribute the most to its profits.

Vodafone, on the other hand, is under pressure to announce its next chief executive officer, who can pull the company out of these difficult times. The company needs a turnaround strategy that can reduce its debt and strengthen its position in its leading markets, like Germany.

We have used the TipRanks Stock Comparison tool for the UK market to compare these stocks on different parameters like dividends, analyst ratings, target price, and more. This tool comes in handy when an investor has to choose between two or more stocks.

Let’s have a closer look at them.

Vodafone – All Hopes on the New CEO

Founded in the UK, Vodafone provides fixed-line and mobile network services in more than 20 countries, mainly in Asia, Europe, and Africa.

The company has definitely seen better days. The stock is at its lowest point in the last five years. Moreover, earnings are in bad shape and costs are soaring. The company’s debt position is also worrisome, having further increased by €3.9 billion to a total of €45.5 billion in the first half of the fiscal year 2023.

Higher debt is mainly driven by dividend payments, share buybacks, and cash outflows. The company currently has a dividend yield of 8.62%, which is attractive for the shareholders. But the main question remains: how long the company will be able to sustain these dividends?

Despite the challenges, the company’s business performance in Africa and Europe was commendable. In the first half of FY 2023, the group’s revenue increased by 2.5% to €22.9 billion, and the operating profit increased by 12% to €2.9 billion. The company’s main market, Germany, underperformed during the period, which pulled down the earnings by 2.6%.

Moving forward, the company is in the process of deciding the name of its next successor and is currently exploring the options. The company’s CEO, Nick Read, has resigned in 2022 but will stay on as an advisor until March 2023. Analysts are hoping the next CEO will be able to turn things around for the company by exiting the non-profitable segments and focusing on its core strengths in Europe.

Is Vodafone Stock a Buy or Sell?

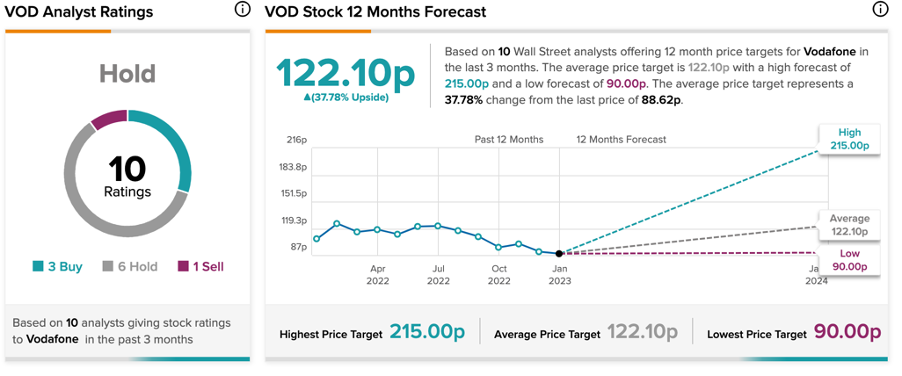

According to TipRanks’ analyst consensus rating, Vodafone stock has a Hold rating.

The target price is 122.1p, which is 37.7% higher than the current price level. The price has a high forecast of 215p and a low forecast of 90p.

Rolls-Royce Holdings – Beginning of the New Growth Phase

Rolls-Royce Holdings is an engineering company that manufactures engines and power systems for airlines and defence.

The company went through a tough time during the pandemic when the airlines were grounded, which in turn hit the company’s revenues.

In 2023, analysts expect the flying hours of airlines to drastically increase as the COVID restrictions are lifted globally. In the recently issued trading update, the company announced the large engine flying hours were at 65% of the pre-pandemic levels. Rolls-Royce renewed its contracts worth $1.8 billion in the defence sector, spread over the next five years.

The company also witnessed a huge jump in its order book, which will be a good support for its revenues in 2023 and beyond. This recovery in the aviation sector will directly increase the company’s revenues and earnings, potentially supporting the company’s falling share prices.

On the flip side, the company has a huge debt pile that is due between 2024 and 2028. However, the analysts remain confident in the company’s recovery. Even though the next two to three years could be tough, the company’s long-term growth is looking good.

Rolls-Royce Share Price Prediction

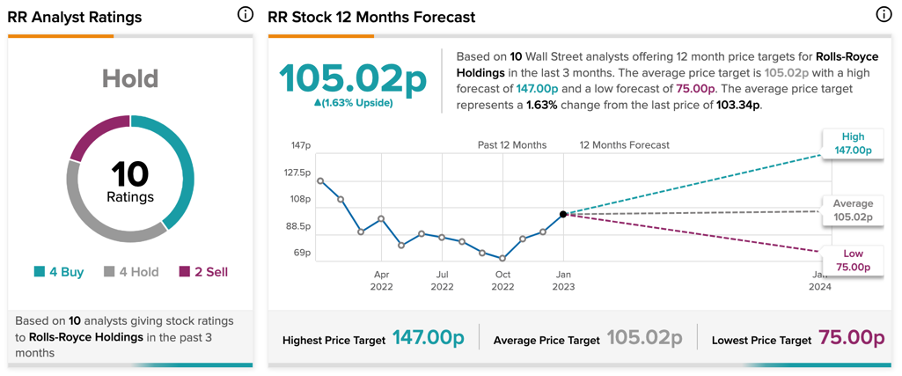

Rolls-Royce stock has a Hold rating on TipRanks, based on four Buy, four Hold, and two Sell recommendations.

The target price is 105p, which represents a change of 1.6% from the current price level.

Conclusion

After comparing both stocks, the Rolls-Royce stock looks like a better opportunity as the recovery has already started for the company.

The shareholders are awaiting the news of the next CEO for Vodafone, and things are looking a bit shaky at the moment.