Repsol S.A.’s (ES:REP) technical analysis on TipRanks suggests a Buy signal for the time period of one month. According to analysts, the stock has a Moderate Buy rating with more than 25% upside potential in the share price.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Based in Spain, Repsol is a global energy company engaged in a diverse range of operations, including exploration and production, refining, sales, and marketing of specialized products such as crude oil, natural gas, and electricity. The company is also committed to the renewable energy sector and aims to achieve net zero emissions by 2050.

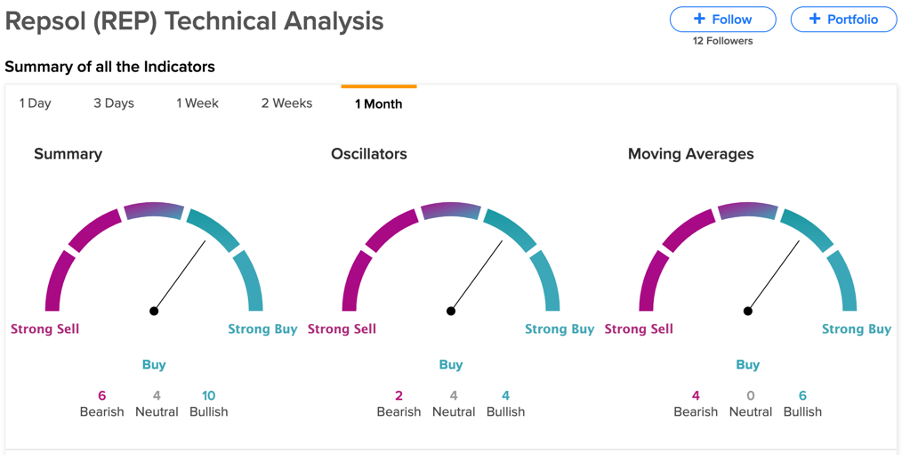

Technical Analysis

The overall assessment suggests a Buy recommendation within a one-month timeframe based on the technical analysis of Repsol. This conclusion is derived from Buy signals observed in both the moving averages and oscillators. The analysis reveals a total of 10 bullish, four neutral, and six bearish signals.

Furthermore, the 20-day and 50-day exponential moving averages both indicate a Buy signal for the stock. On the other hand, the short-term exponential moving average is 13.15, higher than the current trading price, suggesting a Sell.

The stock’s RSI (relative strength index) of 54.88 suggests neutral action for a 1-month period.

What are Analysts’ Predictions?

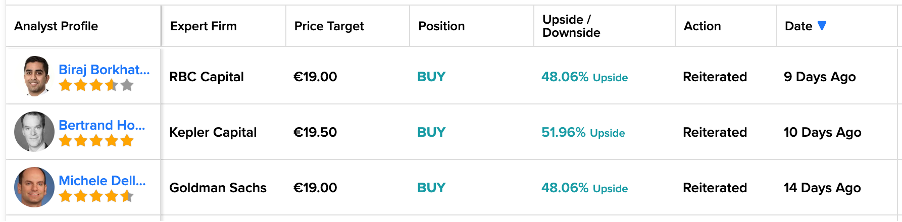

In the past 15 days, analysts have reiterated their Buy ratings on the stock, showcasing optimism regarding its future prospects.

Analysts Biraj Borkhataria from RBC Capital and Michele Della Vigna from Goldman Sachs predict 48% growth in the share price. Similarly, Bertrand Hodee, an analyst from Kepler Capital, anticipates an upside potential of 52%.

Is Repsol a Buy?

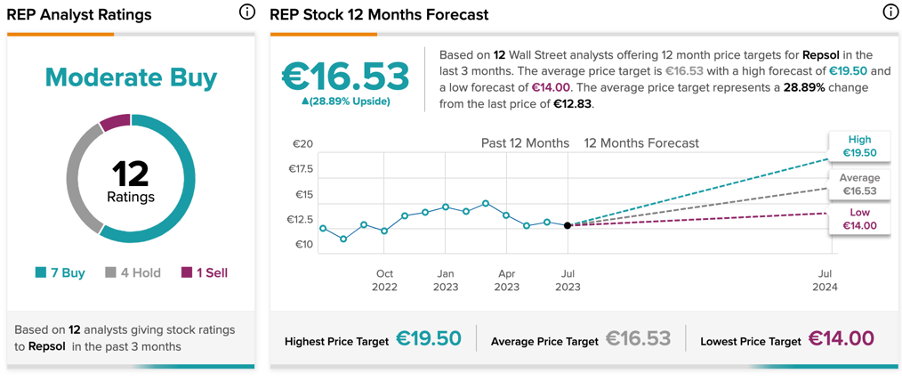

On TipRanks, REP stock has a Moderate Buy rating backed by seven Buy, four Hold, and one Sell recommendations.

The average price target assigned by analysts is €16.5, indicating a potential upside of 28.8% from the current levels.

Conclusion

The TipRanks Technical Analysis tool provides a comprehensive range of technical indicators to assist you in making well-informed investment decisions.

The analysis indicates that REP has a Buy signal for a 1-month period. Moreover, analysts are also confident in the fundamental aspects and have rated the stock a Moderate Buy.