French carmaker Renault (FR:RNO) is offloading a 5% stake in Japanese automaker Nissan (DE:NISE) for €765 million under a share buyback agreement between the two companies. The proceeds from the stake sale would support Renault’s launch of its electric vehicle (EV) unit Ampere, which it hopes to spin off and list next year. RNO shares are down over 1% on the news, while Nissan shares also lost value in its Japanese bourse listing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Renault will mark a €1.5 billion capital loss in its books to reflect the sale price, though the transaction will not impact its operating income. Nissan will cancel all the shares that it will buy back from Renault today, thus reducing its share float. Nissan shares have lost 48.5% of their value in the past five years.

Changing Dynamics

Renault and Nissan are part of an alliance that has grown bitter after the arrest of their common Chairman, Carlos Ghosn, in 2018. The automakers have decided to wind down the alliance, with the aim of reducing their cross-shareholdings to 15% from 43%. The 5% stake sale is Renault’s first sale following the renewed terms of the alliance. Under the new alliance structure, Renault had already transferred 28.4% of Nissan shares into a French trust on November 8.

Post this sale, Renault will still hold Nissan shares worth between €3 and €3.5 billion, based on the closing price on December 11. Renault aims to wind down Nissan’s stock position gradually in 2024 in a bid to regain its investment-grade rating.

Renault wants to make a noticeable comeback in the EV industry with Ampere. Reports suggest that Nissan is also expected to invest in the Ampere unit.

Is Renault a Buy or Sell?

Following the share sale news, analysts from two research firms gave contrasting views on Renault shares.

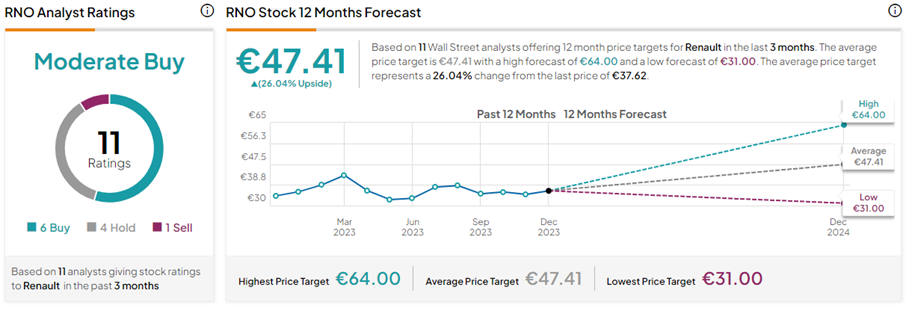

Bernstein analyst Daniel Roeska maintained his Buy rating on RNO stock with a price target of €55.00 (46.2% upside). On the contrary, UBS analyst David Lesne reiterated his Sell rating on RNO shares, while keeping the price target unchanged at €31.00 (17.6% downside).

Overall, analysts have a Moderate Buy consensus rating on RNO stock based on six Buys, four Holds, and one Sell rating. The Renault share price forecast of €47.41 implies 26% upside potential from current levels. Year-to-date, RNO shares have gained 13.5%.