Renault Group (FR:RNO) is a global automobile manufacturing company known for its cars, light vehicles, electric cars, and more. The company operates its manufacturing facilities worldwide. Both the share price and sales of the company are now on an upward trajectory, showing signs of recovery. Recently, the shares experienced a notable surge following the company’s announcement of a positive vision for 2023. The stock has gained around 12% in the last month.

Improved Outlook

In June, Renault Group revised its financial outlook for the full year 2023 to a higher level, considering the Group’s current performance, which surpasses initial expectations. The success of its new models, particularly the Austral SUV and the Dacia Jogger hybrid, has played a significant role in this achievement.

The company raised its operating margin forecast to be between 7 and 8%, as compared to the 6% mentioned earlier. The operational cash flow is expected to be around €2.5 billion, up from €2 billion. The main driving factor behind this improvement is the high-quality sales mix, attributed to its value-focused commercial strategy.

Post announcement, Bernstein analyst Daniel Roeska confirmed his Buy rating on the stock with a forecast of 42% growth in the share price.

What is the Price Target for Renault?

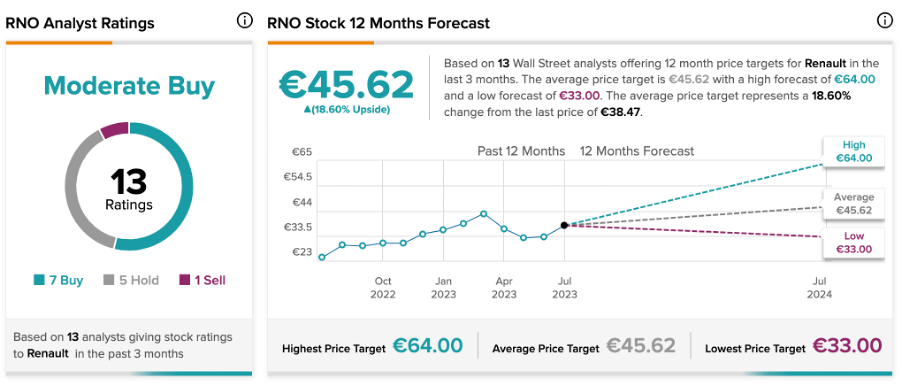

According to TipRanks, RNO stock has a Moderate Buy rating based on a total of 13 recommendations, of which seven are Buy.

The average price target is €45.6, which is 18.6% above the current trading levels.

Conclusion

Renault Group has raised its financial outlook for the year thanks to its ongoing cost reduction efforts and the launch of new models.

The company will publish its first-half earnings for 2023 and expects its operating margins to exceed 7%. Investors are looking forward to the updated numbers, as the company is determined to restore its margins after years of restructuring.