By utilizing the TipRanks Daily Analyst Rating tool for the French market, we have identified three stocks that have been assigned Buy ratings from analysts yesterday. French companies Renault (FR:RNO) and Kering SA (FR:KER) have reported their quarterly earnings for 2023, and analysts have responded positively to the results.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Based on analysts’ assessments, RNO and KER have Moderate Buy Ratings and offer an upside potential of more than 20% in their share prices.

Let’s take a look at these shares in detail.

Is Renault a Buy or Sell?

French automobile manufacturer Renault posted first-half earnings last week, exceeding expectations. The numbers were driven by strong demand, improved pricing policies, and better cost management. The company also achieved its highest-ever operating margin of 7.6%, which is already approaching its 2025 target.

Yesterday, Bernstein analyst Daniel Roeska confirmed his Buy rating on the stock at a price target of €55.0. This implies an upside potential of more than 40% in the share price. Roeska believes “the continued pricing strength of Renault’s models will calm fears of disruptive competitive threats in the near term.” He also maintained his earnings forecast for 2024 and 2025 on the “back of a very strong model cycle and cost improvement.”

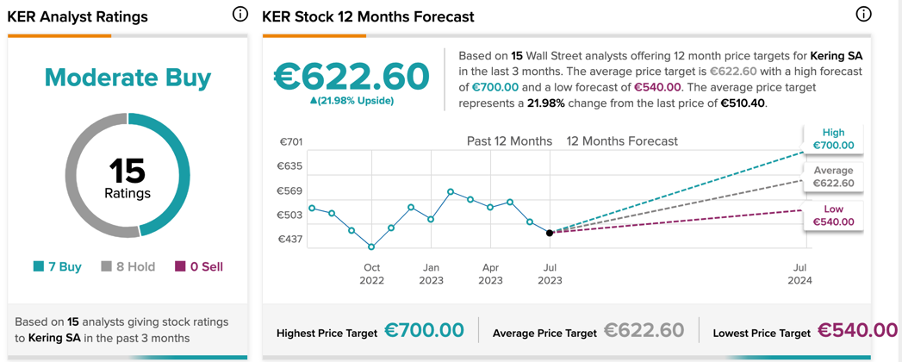

Overall, RNO stock has a Moderate Buy rating backed by a total of 14 recommendations. It includes eight Buy, five Hold, and one Sell ratings. The average price forecast is €47, which is 21.3% higher than the current trading levels.

Is Kering a Good Stock?

Kering is a luxury goods manufacturer with brands like Gucci, Saint Laurent, Bottega Veneta, Balenciaga, and more in its portfolio. The company’s product range includes handbags, shoes, clothing, jewelry, etc.

Last week, the company also published its half-yearly earnings for 2023, but with weak numbers due to lower sales in the U.S. The company also announced the acquisition of 30% of Valentino for €1.7 billion in its results. It also included an option for the company to acquire the remaining stake over the next five years.

Yesterday, analyst Thomas Chauvet from Citigroup confirmed his Buy rating on the stock, predicting a growth rate of 37.6% from the current level.

On the same day, Barclays analyst Carole Madjo reiterated her Hold rating on the stock with a more modest upside of 9% in the share price.

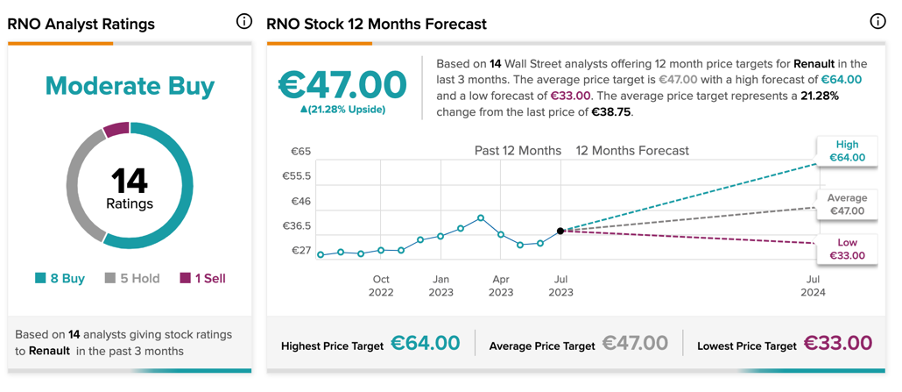

On the whole, KER stock has a Moderate Buy rating based on a total of 15 recommendations from analysts. It includes seven Buy and eight Hold ratings. At an average price of €622.6, analysts predict a growth rate of 22%.