UK-based Reckitt Benckiser Group PLC (GB:RKT) yesterday announced a leadership change in the company with the appointment of new CFO Shannon Eisenhardt from Nike Inc. (NYSE:NKE). Eisenhardt is set to succeed Jeff Carr, who is scheduled to retire in March 2024 after a four-year tenure with the company.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Carr joined Reckitt in 2020 and has played a pivotal role in the company’s transformation program. Under his regime, the company achieved financial strength with lower debt levels and higher shareholder values.

Reckitt’s shares traded up by 0.71% during the day after the announcement.

The Replacement

Carr will be replaced by Shannon Eisenhardt, who is currently serving as the CFO at Nike Consumer, Brand, and Marketplace. Eisenhardt joined Nike in 2015 and has also been the finance head for North America and emerging markets. She also brings consumer and retail experience from her solid tenure of 18 years at Procter & Gamble prior to joining Nike. The company’s management is optimistic about this new change and describes Eisenhardt as a “proven strategic and operational leader.”

Eisenhardt will join the Reckitt board as an executive director and CFO-designate in October. Eisenhardt’s annual salary will amount to £0.76 million, accompanied by a pension allowance of 10%. Additionally, she will have the opportunity to participate in the company’s current annual bonus plan.

This news came as the company was already looking forward to welcoming its new CEO by the end of this year. In April 2023, Reckitt announced that its current CEO, Nicandro Durante, would be stepping down in December 2023, and Kris Licht would take over the role.

Are Reckitt Shares a Buy?

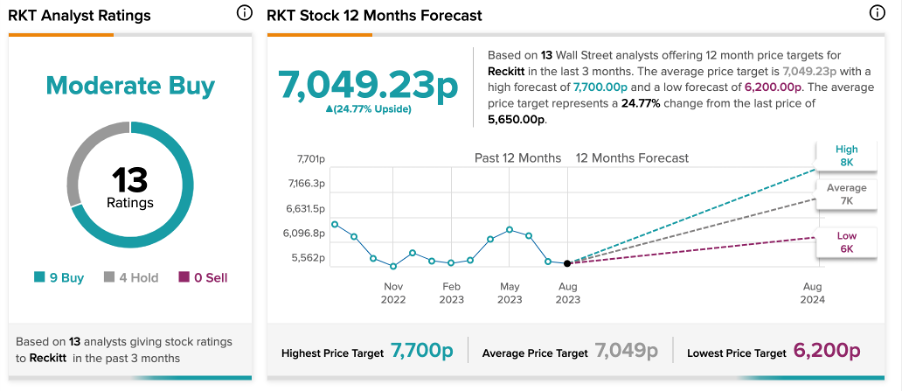

After the announcement of the new CFO, four analysts confirmed their ratings on the stock.

Iain Simpson from Barclays and James Edwardes Jones from RBC Capital have maintained their Buy ratings, predicting around 36% upside in the share price. Analysts from Jefferies and Bernstein have recommended a Hold rating on the stock.

Reckitt shares have proven to be a valuable addition to investors’ portfolios over the long term, offering a mix of capital appreciation and income growth. However, in the past three months, the stock has experienced a decline of approximately 11% from its peak in May. Analysts are still bullish on the share, considering its strong brand power, which gives it an edge in the current inflationary environment.

According to TipRanks’ analyst consensus, RKT stock has a Moderate Buy rating backed by a total of 13 recommendations. It includes nine Buy and four Hold ratings. The average share price forecast is 7,049.2p, which is 24.7% higher than the current price level.