British consumer goods companies Tesco PLC (GB:TSCO) and British American Tobacco (GB:BATS) are well-known brands in the country. Analysts feel their stocks are a safer option during these uncertain times as their product demand is less impacted by any economic cycle.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

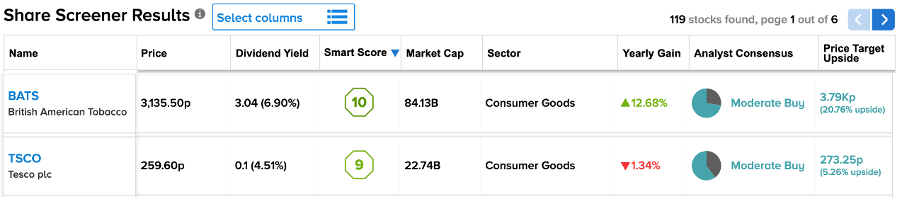

Here, we have used the TipRanks Share Screener tool to screen these two stocks from a particular sector. This tool is a perfect way to choose stocks from a huge database based on our choice of parameters.

British American Tobacco (BAT)

BAT is a UK-based tobacco manufacturing company with some leading brands, such as Camel, Newport, Dunhill, Vuse, Velo, etc., in its portfolio.

With its huge customer base in different geographies and brand power, the company enjoys a huge advantage in terms of higher demand and margins. With a decline in the combustible cigarette market, the company has conveniently transformed itself with a less risky range of products under its non-combustible segment.

The company reported its 2022 annual results with a 40% growth in its new categories’ revenues of £2.9 billion as compared to the previous year. Overall, the revenues were up 7.7% to £27.6 billion. The company is enjoying higher volumes and market share for its new categories of business and targets to turn it profitable by 2024.

British American Tobacco Stock Forecast

Analysts remain bullish on the stock based on its dominant sales volume and its dividend policy. The company has a dividend yield of almost 7%, making it among the top dividend payers on the FTSE 100 index.

Analysts have reiterated their Buy rating on the stock following its earnings.

According to TipRanks’ analyst consensus, BATS stock has a Moderate Buy rating based on a total of 11 ratings.

The average target price is 3,786.3p, which is 20% higher than the current price level.

Tesco PLC

Tesco is a leading retailer in the UK, providing groceries and other consumer goods.

The stock has started the year on a positive note and has gained 13% YTD after hitting a low point in October 2022.

Analysts and investors are awaiting the sale of Tesco’s banking arm, which could further push the stock price. Analysts feel the sale of Tesco Bank would help the company focus on its core business, which could attract more investors.

In January, the company announced its Q3 trading update, with total group sales growing 5.7% quarter-to-date. This was an outcome of strong growth across stores and getting online sales back on track. The company’s market share also stood strong at 27.5%, despite the cost of living crisis. Tesco also confirmed its full-year operating profit guidance to be between £2.4 – £2.5 billion.

The positive quarterly numbers have led to more analysts’ confidence in the stock.

Is Tesco a Buy or Sell?

TSCO stock has a Moderate Buy rating on TipRanks, based on three Buy and two Hold recommendations.

The average target price is 273.25p, which is 5.2% higher than the current price.

Conclusion

Time and again, these companies with their strong brands have proved their resilience and remained consistent with their growth. With high inflation engulfing countries globally, investors could add these stocks to balance their portfolios.

Both TSCO and BATS have Buy ratings from analysts.