TUI AG (DE:TUI1) returned to the profit zone in its Q3 earnings report for 2023, backed by strong demand for its holiday travel. The earnings before interest and tax increased to €169 million as compared to a loss of €27 million last year, making it the first profitable quarter since the pandemic. The company mentioned that this trend has strengthened its anticipation of a successful summer season as well as the fiscal year 2023.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

On the contrary, the shares went in the opposite direction and lost 3.89% yesterday after the results announcement. The stock price is currently facing a challenging period, having already declined by 22% YTD.

Based in Germany, TUI Group operates as a key player in the tourism industry, providing a wide range of travel and holiday services across major destinations worldwide.

Return to Profitability

The company’s operational performance moved closer to pre-COVID numbers, reflecting robust demand for its offerings. The group’s revenue surpassed pre-pandemic levels by 11%. In Q3, the company’s revenues grew by 19% to €5.3 billion, well supported by higher volumes and prices across segments. The company catered to 5.5 million customers in this quarter.

TUI, which is known for its wide range of holiday and travel services, is optimistic that 2023 will be a “good year” as the summer booking levels remain strong. The company has a base of 12.5 million customers for summer 2023. Across the entire group, bookings stand at 95% of the levels seen in the summer of 2019. As of now, 86% of the capacity for the ongoing summer season has been sold.

Supported by consistent and robust bookings, the company has reaffirmed its anticipation of achieving a notably higher underlying EBIT for the full year 2023.

What is the Prediction for TUI Stock?

TUI shares have faced significant challenges over the last five years, plummeting by almost 90%. In 2023, shares experienced a major setback in March when the company announced a rights issue at a discounted rate. The dull performance is mainly due to the worldwide travel upheaval caused by COVID-19 and the company’s longstanding burden of debt.

However, now that the company’s numbers are moving back to pre-COVID levels and it is already working on reducing its debt, it could be a good chance for investors to accumulate some shares at this price.

In Q3 2023, the company reduced its net debt by €1.1 billion to €2.2 billion as of June 2023. The analysts believe more could be done in this area as the debt level is still notably high as compared to profits.

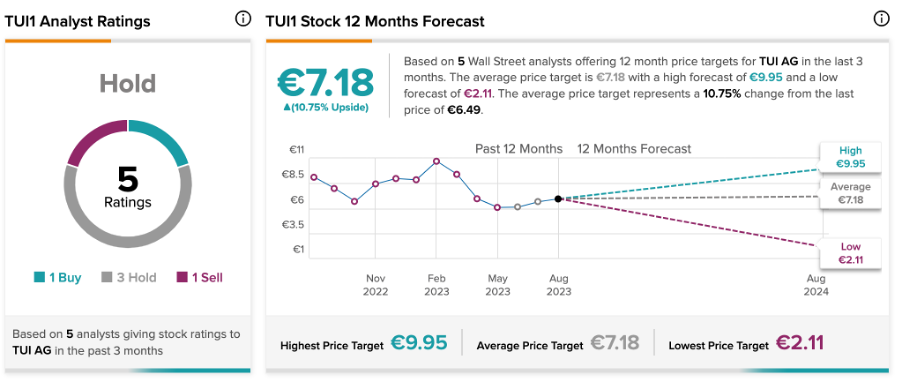

According to TipRanks, TUI1 stock has a Hold rating based on one Buy, three Hold, and one Sell recommendations.

The average target price of €7.18 implies a growth of 10.7% on the current trading level.