German companies Allianz (DE:ALV) and Porsche Automobil Holding (DE:PAH3) are paying regular dividends to their shareholders. Analysts have assigned Buy ratings to these companies, anticipating an increase in their share prices. These stocks offer the perfect combination of capital appreciation and stable dividend income for investors.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

TipRanks provides users with a range of tools designed to assist in selecting the appropriate dividend stock according to their specific requirements. Dividend Stocks, Dividend Calculator, and Dividend Calendar are among the tools available, simplifying the process of screening and selecting stocks within a specific market.

Let’s take a look at the two stocks in detail.

Allianz SE

Based in Germany, Allianz is a renowned insurance company with a widespread presence in more than 70 countries. The company provides a comprehensive range of insurance and asset management solutions, catering to diverse needs.

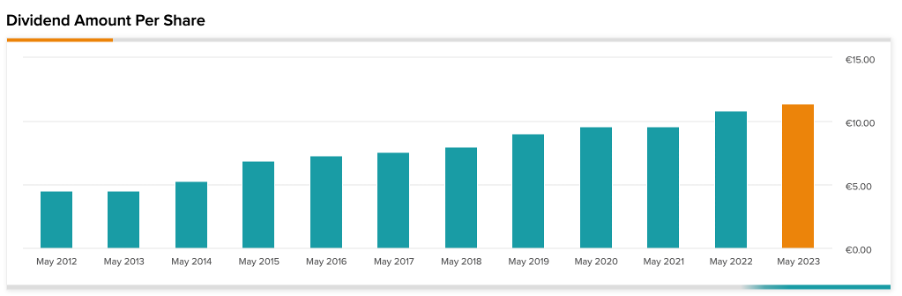

Allianz has a dividend yield of 5.3%, which is higher than the sector’s average of 2.1%. After achieving a record operating profit, Allianz increased its dividend to €11.4 per share in 2022, as compared to €10.8 paid in 2021. The company’s management expressed confidence in achieving an annual dividend increase of at least 5% in the upcoming years. Consequently, the dividend is anticipated to reach a minimum of €12.00 in fiscal year 2023 and €12.60 in fiscal year 2024.

Overall, analysts were highly impressed by Q1 2023 earnings, which were above expectations, mainly driven by its investment income. Analysts believe that the company is projected to maintain its growth trajectory, and there are anticipations of further dividend payouts in the upcoming quarters.

Is Allianz a Good Stock to Buy?

According to TipRanks, ALV stock has a Strong Buy rating backed by a total of nine ratings, of which seven are Buy.

The average price forecast is €252.38, which is 25% higher than the current trading levels.

Porsche Automobil Holding SE

Porsche SE functions as a holding company, with investments focused on the realms of mobility and industrial technology. The company possesses a majority stake in the ordinary shares of Volkswagen AG (DE:VOW).

Recently, in July, the company paid a dividend of €2.56 per share for 2022. The total payout for the year was €783 million, which was similar to the previous year. Even with increased financial liabilities, Porsche SE remains dedicated to providing stable and dependable shareholder remuneration. The management remains committed to repaying loans and has also maintained a stable dividend for the year. Currently, the company has a dividend yield of 4.63%.

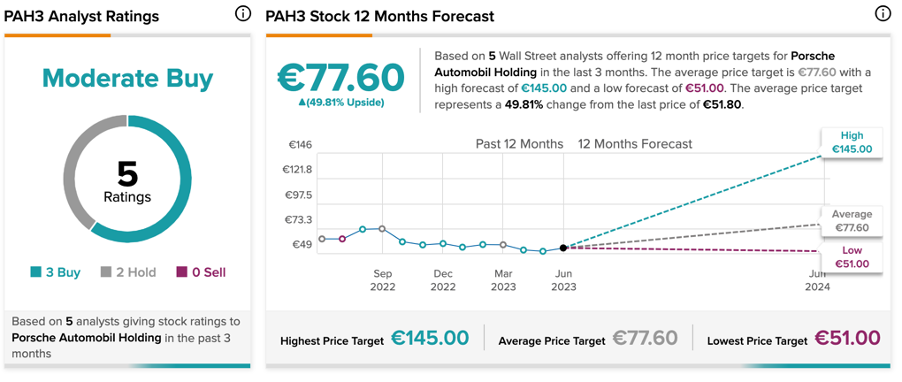

Yesterday, Fabio Holscher from Warburg Research reiterated his Buy rating on the stock, forecasting almost 30% growth in the share price. The price target was reduced from €84 to €67.

Is Porsche Stock a Good Investment?

PAH3 stock has a Moderate Buy rating on TipRanks based on three Buy and two Hold recommendations. The average price target of €77.6 implies an upside of almost 50% in the share price.

Conclusion

Analysts are optimistic about the upcoming quarterly numbers for ALV and PAH3, strengthening their dividend prospects. The Buy ratings and potential for share price growth make them attractive investment options for investors.