While some investors express concerns about declining share prices, income investors are content with the higher yields they are receiving. SSE PLC (GB:SSE) and Phoenix Group (GB:PHNX) are two such options in the UK market.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In addition to offering appealing dividends, both stocks have received Buy ratings from analysts, indicating the possibility of further growth potential.

TipRanks provides a range of tools to assist users in selecting suitable dividend stocks that align with their requirements. These tools include Top Dividend Shares, Dividend Calculators, and Dividend Calendars, which simplify the process of screening and selecting stocks within specific markets.

Let’s see the two stocks in detail.

Phoenix Group Holdings

As the UK’s leading savings and retirement company, Phoenix Groups operates across a broad spectrum of insurance, pensions, and retirement solutions.

The company has a solid track record of generating higher value for its shareholders. The company has a high dividend yield of 8.82%, against the industry average of 2.14%. Recently, in May 2023, the company paid its final dividend of 26p per share for the year 2022, which was 5% higher than the previous year’s payments. The total dividend for 2022 was 50.8p per share, up from 48.9p paid in 2021.

The company’s resilient business model is designed to withstand fluctuations in the economic cycle, which makes it an ideal choice in current times. Moreover, its strong cash generation ensures the long-term sustainability of growing dividends. The company generated £1.5 billion of cash in 2022, surpassing its target range of £1.3bn to £1.4bn for the year.

Are Phoenix Group Shares a Good Buy?

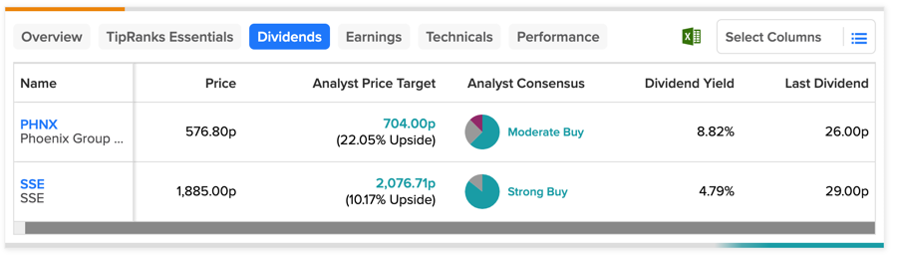

According to TipRanks, PHNX stock has a Moderate Buy rating based on a total of eight recommendations. The average price forecast is 704.0p with a high forecast of 830p and a low forecast of 627p.

The price target implies an upside of 22% on the current trading levels.

SSE PLC

SSE is one of the major electricity network companies in the UK, taking a leading role in renewable energy generation. The company possesses a diverse range of business segments, providing it with greater resilience against shifting market conditions.

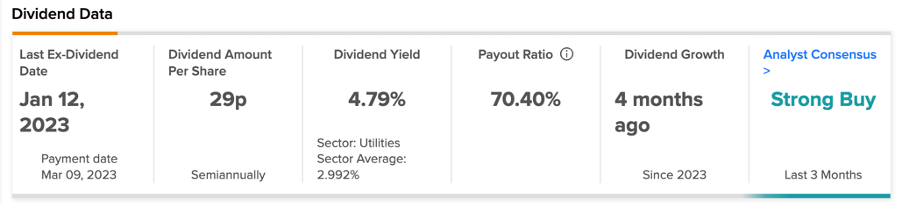

The company paid a total dividend of 85.7p per share in 2022, which led to a dividend yield of almost 5%. This was around 8% higher than the payment made in 2021.

Moving forward, Citigroup expects the company to pay a dividend of 95.4p per share in the fiscal year 2023. However, for 2024, the company has announced its intention to “rebase” the dividend to 60p per share in order to bolster its investment strategies. The company also revised its guidance for its EPS for FY2023, raising it from 150p to over 160p due to favorable market conditions.

SSE Share Price Forecast

SSE stock has a Strong Buy rating on TipRanks backed by six Buy and one Hold recommendations.

The average price prediction is 2,076.71p, which is 9.42% higher than the current price level.

Conclusion

Given that the average dividend yield for the FTSE 100 stands at a mere 3.6%, stocks like Phoenix Group and SSE are offering substantial returns to investors. The Buy ratings from analysts further enhance the attractiveness of these stocks.