The UK-based Pendragon PLC’s (GB:PDG) shares skyrocketed today after the company announced its plan to divest its UK motor and leasing businesses to Lithia Motors, Inc. (NYSE:LAD) for £280 million. Out of this amount, £240 million will be returned to Pendragon’s shareholders through special dividends. With the sale of its dealership business, the company remains committed to focusing on its dealer management software (DMS) business, Pinewood. The deal value includes £250 million for the car business and an additional £30 million for a stake in Pendragon’s software business.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Pendragon will retain its current listing on the London Stock Exchange while undergoing a name change to become Pinewood Technologies PLC. Following the completion of the deal, which is subject to shareholders’ approval, Lithia will own 16.67% of Pinewood Technologies.

Shareholders celebrated the news, and the stock surged approximately 26% on Monday at the time of writing. This marks a remarkable 45% increase in share value over the past six months.

More About the Deal

Under this deal, the companies also entered into a strategic partnership to expand Pendragon’s dealer management software business into North America. The joint venture in the U.S. market will be owned 51% by Lithia. Along with the expansion in the North American markets, Pendragon’s Pinewood will be deployed across Lithia Motors’ existing 50 UK locations.

Pendragon stated that the ownership in the U.S. joint venture, the proceeds from the transaction, and the retained Pinewood business collectively have a value of 27.4p per share.

Pendragon believes that with this deal, the company is ideally positioned to build upon its market-leading position. Bill Berman, who will be the future chief executive of Pinewood, expressed that Lithia is “the perfect partner to help accelerate Pinewood’s push into the hugely attractive North American market.”

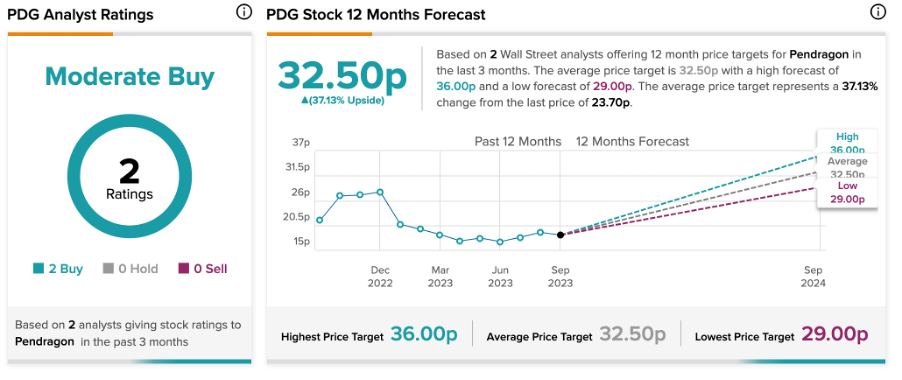

What is the Stock Price Forecast for Pendragon?

According to TipRanks’ analyst consensus, PDG stock has a Moderate Buy rating based on two Buy recommendations. The Pendragon share price forecast is 32.5p, which is almost 37% higher than the current price level.