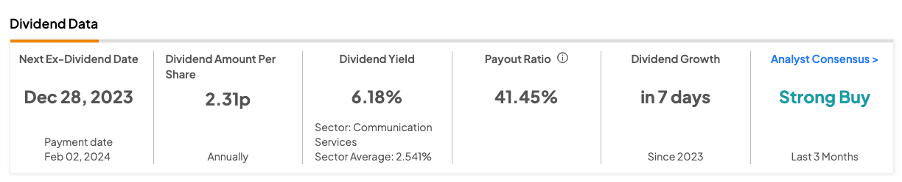

The UK-based telecom giant BT Group PLC (GB:BT.A) offers investors an opportunity to enhance their income portfolios with a dividend yield of 6.18%, surpassing the industry average. The stock is set to go ex-dividend next week on December 28, providing investors with a chance to acquire it and become eligible for the upcoming payment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BT Group is among the world’s leading telecommunications companies, offering fixed-line, mobile, and broadband services in the UK and other countries globally.

TipRanks offers a variety of tools to help users identify dividend stocks that match their preferences. In this instance, we have used the TipRanks Top Dividend Shares for the UK market. This tool compiles a comprehensive list of high-dividend-paying companies, along with various other parameters for users to consider.

BT Group’s Dividend History

BT Group typically distributes its dividends twice a year, with interim dividends paid in February and final dividends in September.

For Fiscal year 2023/24, the company announced an interim dividend of 2.31p per share, aligning with its payout policy to distribute 30% of the prior year’s full-year dividend. This amount is similar to the company’s interim payment of the previous year and will be paid on February 2, 2024.

The company has experienced a turbulent dividend history in recent times. It scaled back shareholder returns during the pandemic and eliminated them entirely in the Fiscal year 2020/21 as part of its efforts to strengthen the balance sheet and proceed with its fibre rollout program. In the Fiscal year 2021/22, the dividend was resumed with a payment of 7.7p per share.

Favourable Outlook

Last month, the company reported revenues and earnings growth in its first-half results for FY23/24 and confirmed its guidance for the full year. Revenues during the first half grew by 3% on a pro forma basis, and adjusted EBITDA increased by 4%.

Looking forward, the company expects growth in adjusted revenue and EBITDA on a pro forma basis. Capital expenditure, excluding spectrum, is anticipated to be about £5 billion. The normalized free cash flow is projected to be at the upper end of the £1 billion to £1.2 billion range.

What is the Forecast for BT Shares?

According to TipRanks consensus, BT.A stock has received a Strong Buy rating based on three Buys and one Hold recommendation. The BT Group share price target is 213.33p, reflecting an almost 70% increase from the current trading level.