ASX-listed Origin Energy Limited (AU:ORG) is ramping up its stake in the U.K.’s privately held renewables energy company, Octopus Energy. Origin announced yesterday that it will invest a further £280 million in Octopus, upping its stake by 3% to 23%. ORG shares rose 3.2% on the news today.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Origin Energy is the largest energy retailer in Australia, serving around 4 million customers. Meanwhile, Octopus Energy is Britain’s largest independent energy supplier, boasting more than 11 million customer accounts. Its Kraken platform is one of the most favored technology platforms for energy and other utilities globally.

Further Details About Origin’s Investment

Origin’s additional investment comes as Octopus floated another funding round, valuing the British company at £6.2 billion. Octopus’ valuation has increased by 60% since its last funding round in December 2021. Aside from Origin, other investors in Octopus include the Canada Pension Plan Investment Board and Generation Investment Management.

Origin had initially taken a 20% stake in Octopus in May 2020. With the additional equity, the value of Origin’s current investment stands at roughly £1.43 billion.

Octopus has strategically increased its business and customer base through the Kraken platform. Kraken now has 52 million contracted accounts globally, taking it a step closer to reaching 100 million customers by 2027.

Origin CEO Frank Calabria believes that the increased stake in Octopus reflects the company’s optimism about various aspects, including its strategy, management team, and proprietary technology platform. Also, the move is in line with the company’s energy transition goals.

Interestingly, some reports suggest that Origin shareholders rejected the AU$19.1 billion takeover offer led by asset manager Brookfield Corporation (NYSE:BN) because it thoroughly undervalued Origin’s business prospects given its Octopus investments.

What is the Price Target for Origin?

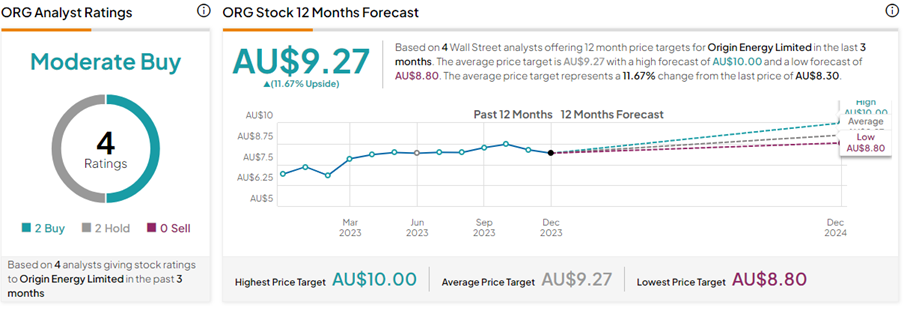

On TipRanks, the Origin Energy share price target of AU$9.27 implies 11.7% upside potential from current levels. Also, ORG stock has a Moderate Buy consensus rating based on two Buys versus two Hold ratings. Year-to-date, ORG shares have gained 13.7%.