The FTSE 100 has recovered well from the October lows as political stability under the new leadership has restored investor confidence in the economy to some extent. Nonetheless, global macro uncertainty and inflationary pressures could continue to weigh on stocks. During these challenging times, recession-proof stocks could be a good addition to investors’ portfolios. Let’s take a look at one such stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Leading alcoholic beverage maker Diageo (GB:DGE) owns over 200 brands that are sold in more than 180 countries. The company’s popular brands include Smirnoff, Johnnie Walker, Crown Royal, Guinness, and Baileys. Generally, sin stocks, like Diageo, tend to be resilient during an economic downturn as people continue to spend on tobacco and alcohol.

Diageo’s strong market positioning gives it pricing power, which helps the company protect its margins during an inflationary period. Furthermore, Diageo’s premium brands also help in driving better margins. In Fiscal 2022, the company’s premium-plus brands contributed 57% of its net sales.

Back in October, CEO Ivan Menezes stated that the company made a “good start” to Fiscal 2023, with organic net sales growth across all regions. While Diageo expects the operating environment to remain challenging due to a confluence of factors, including the Russia-Ukraine war, the company is confident about its ability to navigate these tough times.

The company is also positive about achieving its medium-term guidance for Fiscal 2023 to Fiscal 2025 of organic net sales growth in the range of 5% to 7% and organic operating profit growth of 6% to 9%.

Is Diageo a Buy, Hold, or Sell?

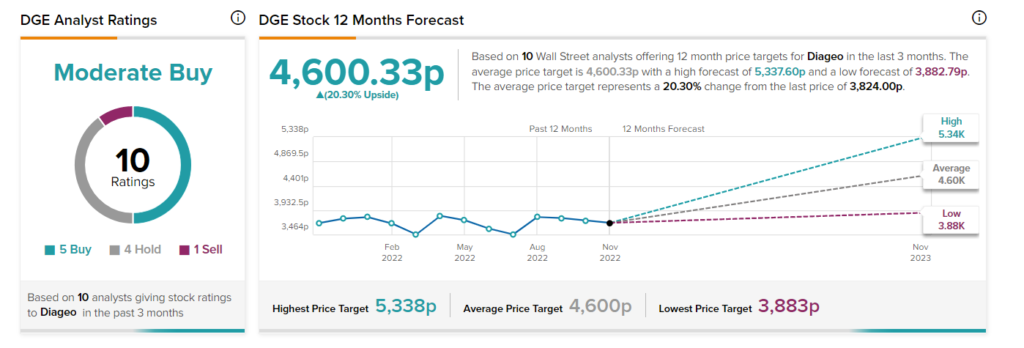

On TipRanks, Diageo scores a Moderate Buy consensus rating based on five Buys, four Holds, and one Sell. The average DGE stock price target of 4,600.33p suggests 20.3% upside potential from current levels.