Today, we have picked up two UK-based companies, Next PLC (GB:NXT) and United Utilities (GB:UU), which were on the minds of investors this week.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Next was in the news after its recent acquisition and annual results, with a cautious outlook for the next year. While, United Utilities released its trading update for its fiscal year 2023, ahead of full results due in May.

Let’s have a look at this news in detail.

Next PLC

Based in the UK, Next is a retail company specializing in clothing, footwear, and homeware products.

Recently, the company announced its acquisition of another UK-based retailer, Cath Kidston, for £8.5 million. This is Next’s third acquisition of a struggling retailer after it bought Made.com and Joules in 2022.

Just a day after the acquisition news, Next reported its full-year earnings for the year ended in January 2023. The sales were up by 8.4% to £5.15 billion, and profit after tax increased by 5% to £711 million. The company also stated that it expects this year to be better in terms of inflation.

Despite reporting better-than-expected results with stronger numbers, the company’s stock ended up in the red, down 4.7%. This was mainly due to the company’s careful approach to the future. The company didn’t upgrade its guidance numbers and maintained a 1.5% decrease in sales and an 8% decrease in pre-tax profits for the year ending in January 2024.

Next Share Price Forecast

According to TipRanks, NXT stock has a Moderate Buy rating based on a total of 12 recommendations.

The average target price is 6,821.4p, which is 6.28% higher than the current price.

United Utilities Group PLC

United Utilities is a UK-based utility company providing water services in the North West of England.

The company’s stock was up 1.5% after it announced its trading update for the fiscal year 2023. According to the update, the company reduced its previous revenue guidance by 1% due to “lower consumption and timing effects.” The earlier expectation was 1% below 2022’s revenues, which were £1.86 billion.

The company also expects higher costs this year, mainly driven by inflation. The company’s net finance expense is expected to be £175 million more than the £306.3 million reported in 2022.

Is United Utilities a Buy or Sell?

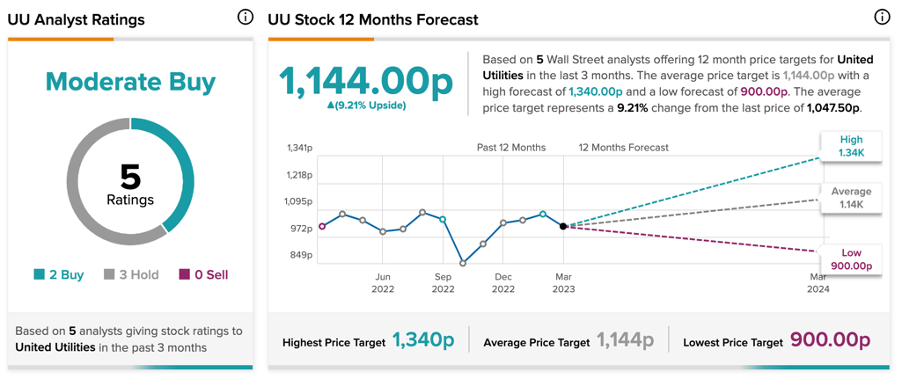

Based on two Buy and three Hold recommendations, UU stock has a Moderate Buy rating on TipRanks.

The average target price is 1,144.0p, which is 9.2% higher than the current price.

Conclusion

Both NXT and UU have taken a cautious approach to their next fiscal year numbers. Analysts expect that as these companies move forward with the year, there could be some upgrades to the guidance numbers, which could lead to further changes in the ratings and price targets.

For now, both stocks have Moderate Buy ratings from analysts.