The FTSE 100-listed retail company Next PLC (GB:NXT) yesterday raised its full-year sales and profit guidance after the company reported sales in the third quarter that exceeded expectations. This marks the fourth upgrade by the company in the last few months. The company stated that even though the quarter was significantly affected by fluctuating weather conditions, overall UK consumer demand has remained steady.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The share price reacted positively and traded up by 4.2% on Wednesday, further extending their gains for 2023 to a total of 23%.

Next is a renowned UK retail brand that offers clothing, footwear, and home goods. The company operates both through its network of physical retail stores and a robust online platform, offering customers the convenience of shopping through various channels.

Strong Q3 Numbers and Positive Outlook

Next reported a growth of 4% in its full-price sales in its Q3 trading statement, surpassing its initial guidance, which projected a 2% increase. Among its channels, online sales were up by 6.5%, while store sales fell by 0.6%. The group reported that its sales were positively influenced by “cooler-than-average weather in August and typical autumnal conditions in late October.” However, sales were also negatively impacted by warmer-than-average weather in September. The UK has witnessed its hottest September on record this year, which has adversely impacted the sales of autumn collections for retailers.

In terms of outlook, Next has revised its expectations for pre-tax profit before exceptional items for the fiscal year ending in January 2024. The company now anticipates a profit of £885 million, which surpasses its previous guidance of £875 million. It further increased its full-price sales for the full-year to £4.74 billion, up from its earlier forecast of £4.72 billion.

Is Next a Buy or Sell?

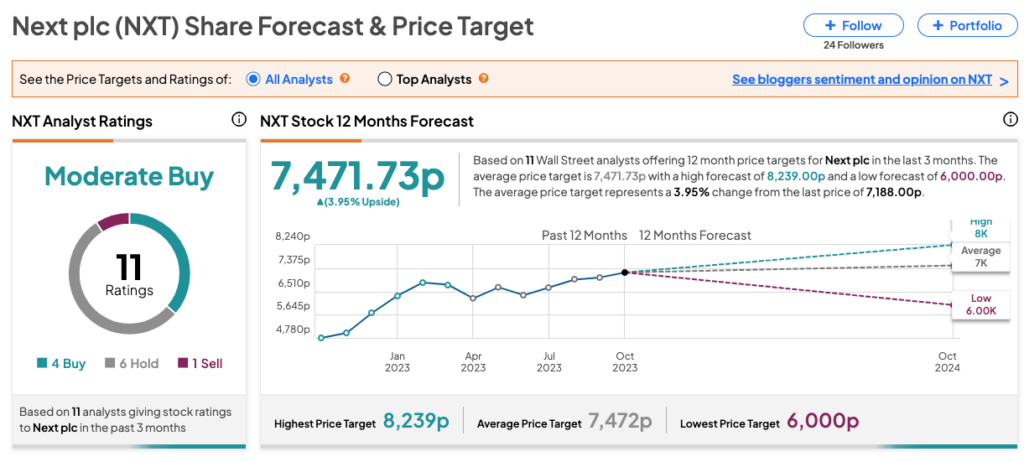

Post-Q3 trading update, analyst David Hughes from Stifel Nicolaus confirmed his Buy rating on the stock yesterday, predicting an upside of 11.3%. Additionally, Morgan Stanley analyst Grace Smalley assigned a Hold rating on the stock yesterday.

NXT stock has received a Moderate Buy rating on TipRanks, backed by a total of 11 recommendations. It includes four Buy, six Hold, and one Sell recommendations. The Next share price forecast is 7,471.7p, which is 4% above the current trading levels.