The FTSE 100-listed Next PLC (GB:NXT) released its trading update for the nine weeks that ended on December 30, 2023. The company stated that its full-price sales increased by 5.7% during this period compared to last year. Next raised its full-year profit guidance to £905 million, up from the previous figure of £885 million, thanks to solid holiday sales. The company now expects its full price sales to grow by 4% in the current fiscal year, up from the prior outlook of 3.1% growth.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Prior to the update, analysts at Citi said that they expect the company to surpass its Q4 sales guidance, driven by its performance during Christmas and its partnership with UK fashion brand Reiss. Citi predicted a full-price sales growth of 4%, which is above the 2% growth that the company had initially projected.

The Next share price traded up by 0.2% on Wednesday, further extending its gain of over 30% in 2023.

Next is a well-known UK retail brand recognized for its clothing, footwear, and home goods offerings.

Here’s What Citi is Forecasting for Next

Moving forward, Citi expects a 2% increase in full-price sales for the company in the upcoming Fiscal Year 2024/25. Meanwhile, as per the trading update, the company expects full-price sales growth of 2.5% during this period.

The optimistic outlook also extends to the company’s EPS, with Citi anticipating a “mid-single-digit percentage increase for the year.” These projections are influenced by the company’s recent mergers and acquisitions, particularly with fashion brands Reiss and FatFace.

On the flip side, Citi is cautious regarding Next stock’s valuation, noting that it is trading at higher multiples even as organic EBIT (earnings before interest and taxes) is expected to remain relatively stable. Consequently, the firm recommends investors to patiently monitor the company’s results in the upcoming fiscal year, backed by its strategic partnerships.

Is Next a Buy or Sell?

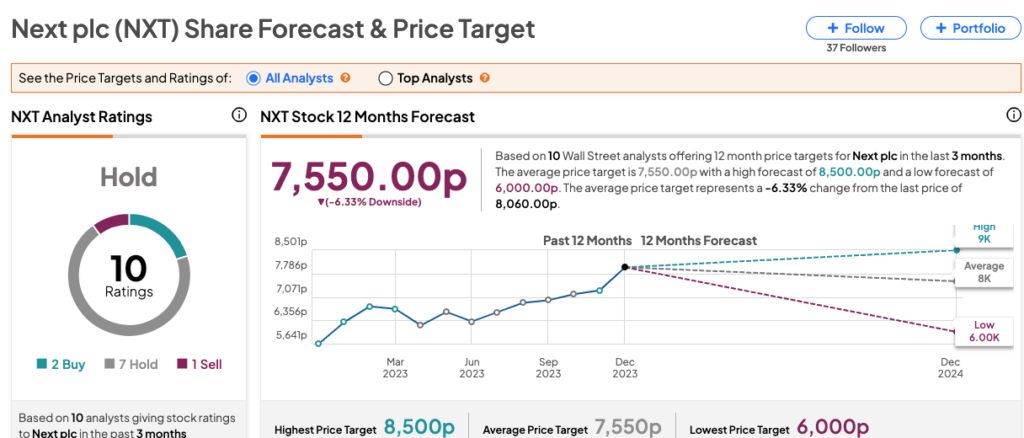

According to TipRanks’ consensus, NXT stock has received a Hold rating, backed by a total of 10 recommendations. It includes two Buys, seven Holds, and one Sell recommendation. The Next share price forecast is 7,550p, which is 6.3% below the current trading levels.