Natwest Group (GB:NWG) shares rose more than 7% on Friday after the British bank announced upbeat Q4 profit and named interim CEO Paul Thwaite as the permanent head, addressing a major uncertainty. The bank’s fourth-quarter pre-tax operating profit declined about 12% year-over-year to £1.26 billion but surpassed analysts’ consensus estimate of £1.02 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Thwaite, who previously headed NatWest’s business banking division, assumed the role of the interim CEO in July 2023 when Alison Rose stepped down following a controversy triggered by the closure of politician Nigel Farage’s accounts with the bank’s subsidiary Coutts.

Natwest’s 2023 Results and Outlook

For the full-year 2023, Natwest’s pre-tax operating profit increased 20% to £6.18 billion. Net interest income (NII) increased 12% to £11 billion, thanks to higher interest rates. The net interest margin expanded by 19 basis points to 3.04% in 2023. However, Q4 net interest margin declined 8 basis points sequentially to 2.86%, as more customers opted for fixed-term accounts to take advantage of high interest rates.

Meanwhile, Natwest announced a final dividend payment of 11.5p per share. This brings the full-year 2023 dividend to 17p, reflecting a 26% year-over-year increase. Overall, the bank declared £3.6 billion of shareholder capital returns. The bank also expressed the intention to start a buyback programme of up to £300 million this year.

Looking ahead, Natwest expects total income (excluding notable items) in the range of £13.0 billion and £13.5 billion in 2024. This guidance fell short of analysts’ total income forecast of £13.8 billion. The guidance reflects the bank’s expectation of falling interest rates. Natwest also issued disappointing guidance for return on tangible equity (RoTE), a key profitability metric. It expects RoTE of about 12% in 2024, down from 17.8% in 2023. It expects RoTE to improve to more than 13% in 2026.

Is Natwest a Good Stock to Buy?

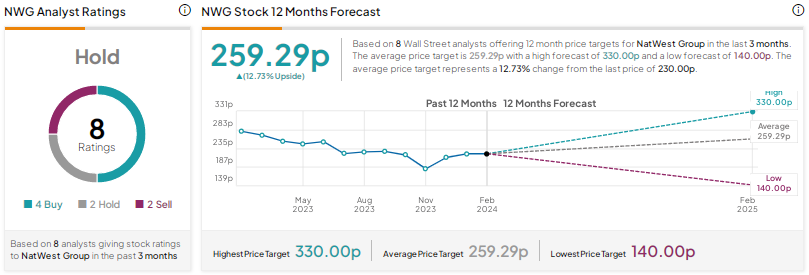

Analysts have a Hold consensus rating on NWG stock based on four Buys, two Holds, and two Sells. The Natwest Group share price target of 259.29p implies nearly 13% upside potential. Shares have declined more than 19% in the past year.