The ASX-listed National Australia Bank Limited’s (AU:NAB) full-year profits for 2023 soared despite facing challenges in the home loan market. In its 2023 annual earnings report released today, the bank revealed a cash profit of $7.7 billion, marking an 8.8% increase from the previous financial year. However, it fell just shy of the consensus expectation of $7.8 billion. The statutory profit grew by 7.5% to AU$7.41 billion in 2023.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Rewarding its shareholders, the bank declared a fully franked final dividend of AU$0.84 per share, showing a notable increase from the AU$0.78 per share paid in 2022. The total dividend for 2023 was AU$1.67 per share, compared to AU$1.51 in the previous year.

NAB is among the top four largest banks in Australia, serving a vast customer base of over eight million individuals.

Key Highlights of the 2023 Annual Results

The bank’s Common Equity Tier 1 (CET1) ratio experienced a year-on-year increase of 71 basis points, reaching an impressive 12.22%. It remains focused on achieving a CET1 capital ratio within the range of 11–11.5%, striking a balance between sustaining a robust balance sheet and enhancing returns for shareholders. NAB’s net interest margin came in at 1.74% for 2023, higher than the 1.65% reported in 2022. The bank witnessed higher interest rates in the first half of 2023, followed by a softening trend in the last six months.

On the other side, the higher interest rate benefit was offset by the declining volumes in the home loan portfolio. The competition in the home loan market remained intense as customers explored alternative options in search of a more favorable deal.

What is the Price Target for NAB?

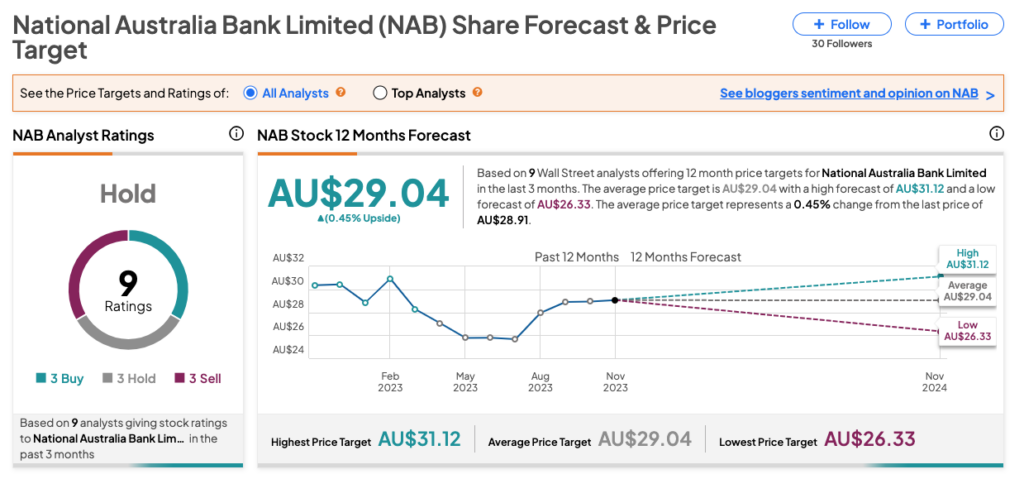

Post-results, today, analyst Brendan Sproules from Citi confirmed his Hold rating on the stock, predicting a downside of around 5% in the share price.

According to TipRanks, NAB stock has received a Hold rating based on three Buy, three Hold, and three Sell recommendations. The NAB share price target is AU$29.04, which is similar to current trading levels.