ASX-listed banks Commonwealth Bank of Australia (AU:CBA) and National Australia Bank Limited (AU:NAB) are well-known dividend payers in the Australian market. The banks maintain their commitment to enhancing returns for shareholders, which proves valuable, especially in the current period of less favorable share price growth.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

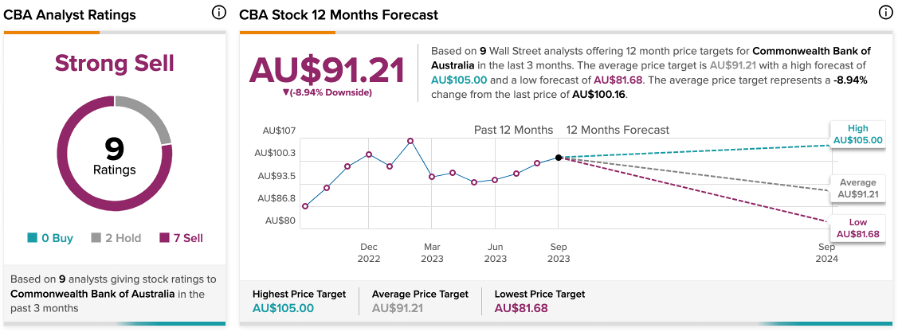

In terms of capital growth, both stocks do not present any upside potential. NAB has a Hold rating from analysts, while CBA has been given a Moderate Sell rating, anticipating a downside of approximately 9%.

Let’s take a look at these companies in detail.

Commonwealth Bank of Australia (CommBank) Dividend History

CBA is the largest retail bank in Australia and provides a wide range of financial services. The bank also has operations in New Zealand, Asia, the U.S., and the UK.

CommBank carries a dividend yield of 4.51%, whereas the sector average is 2.11%. According to the bank’s dividend policy, it aims at distributing dividends at robust and sustainable levels while maintaining a payout ratio of 70-80%. For the fiscal year that ended on June 30, the bank paid a final dividend of AU$2.40 per share. This led to the total dividend for FY23, reaching a record payment of AU$4.5 per share, marking a 17% increase over the dividends paid in FY22.

In its annual results for FY23, the bank posted record profits driven by rising interest rates. However, it anticipates some pressure on net interest margins in FY24 and also warns of higher debt arrears amid increasing cost of living pressures. According to Commsec projects, the bank could pay a dividend of AU$4.41 per share in FY24.

Is CBA a Good Share to Buy?

Currently, analysts hold a negative view of CBA shares, as the stock is undergoing a downgrade cycle. Challenging economic fundamentals and a high valuation have contributed to a consensus Moderate Sell rating on CBA stock. According to TipRanks consensus, the stock has received seven Sell and two Hold recommendations.

The CBA share price target is AU$91.21, which is 9% lower than the current price level.

National Australia Bank (NAB) Dividends

NAB is among the top four largest banks in Australia, catering to over eight million customers.

NAB shares are a popular choice among income investors, and the appeal is evident. Annually, the banking giant distributes a substantial portion of its earnings to shareholders through dividends. In its first-half results for FY23, NAB reported a 17% increase in half-year cash earnings to AU$4.07 billion. The positive results have enabled the board to raise its fully franked interim dividend by 13.7% to AU$0.83 per share. The current dividend yield for NAB is 6.07%.

According to Goldman Sachs forecasts, the bank will announce a final dividend of AU$83 per share for FY 2023 in November. This would result in a total dividend of AU$1.66 per share for the year, marking a 10% increase over the dividend of AU$1.51 per share in FY22.

What is the Price Target for NAB?

According to TipRanks, NAB stock has received a Hold rating based on three Buy, four Hold, and three Sell recommendations. The NAB share price target is AU$29.04, which is similar to current trading levels.

Conclusion

Banking stocks NAB and CBA remain attractive options for income-oriented investors seeking stable dividends in the Australian market.