In the latest update on SoftBank Group Corporation’s (DE:SFTU) (GB:0L7L) deal to sell Fortress to Mubadala, the Financial Times today stated that the Committee on Foreign Investment in the United States (CFIUS) is closely examining the deal.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In May, FT reported that the discussions were in an advanced stage and had been in place since last year. It also stated that an agreement that would aid SoftBank in reducing its debt could be announced this year.

However, according to the latest update, the review is in the preliminary stage, and a decision is not anticipated for several months. The review is prompted by concerns about the United Arab Emirates connections with China.

About the Deal

If the sale proceeds, Mubadala, the sovereign investor based in Abu Dhabi, would emerge as one of the largest credit investors globally by incorporating Fortress’s nearly $50 billion in assets under management. Following the completion, Fortress’ management will retain a 30% stake, while Mubadala will hold the majority share.

Fortress Investment Group is a diversified global investment manager, engaged in a variety of investment strategies, including credit and real estate, private equity, and permanent capital across its portfolio.

SoftBank acquired Fortress for $3.3 billion in 2017, as part of its founder Masayoshi Son’s efforts to establish an asset management arm using its Vision funds. The acquisition was intended to leverage Fortress’s expertise in raising private funds, aligning with SoftBank’s vision to transform its business.

What is SoftBank’s Stock Target Price?

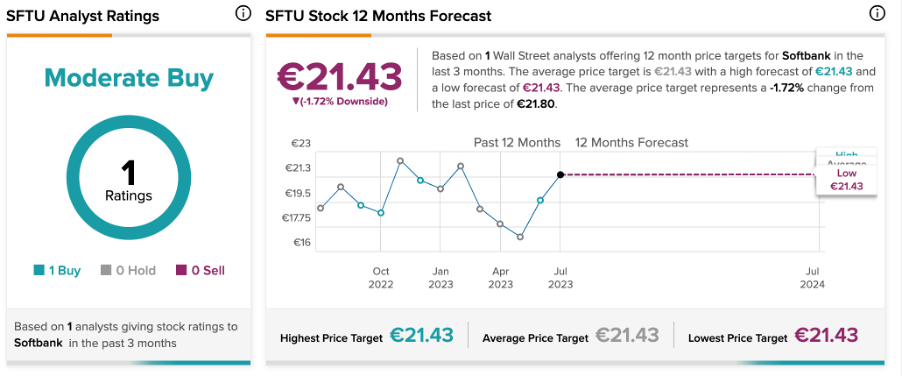

According to TipRanks’ analyst consensus, SFTU stock has a Moderate Buy rating based on one Buy rating from Jefferies’ analyst Atul Goyal.

His price forecast is €21.43, which is 1.72% lower than the current trading levels.