Using the TipRanks Top Dividend Shares tool for the UK market, we have shortlisted three companies that are a part of the FTSE 100 index. M&G PLC (GB:MNG), British American Tobacco (GB:BATS), and Admiral Group (GB:ADM) have dividend yields of more than 7%. The Top Dividend tool simplifies the process of screening high dividend-paying companies in a specific market for users.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In terms of analysts’ ratings, BAT has a Moderate Buy rating on TipRanks, while M&G and Admiral have Hold ratings.

Let’s dig deeper into some details.

M&G PLC

M&G operates as a savings and investment company, offering a diverse range of solutions for long-term savings, investments, and asset management.

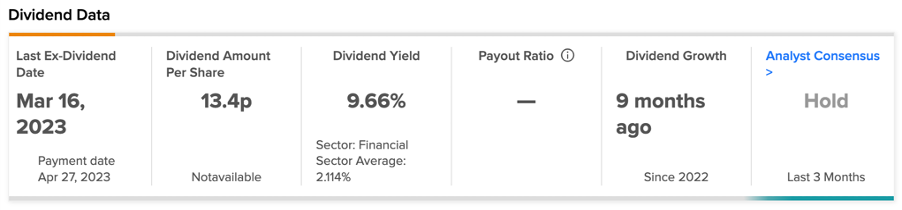

With a dividend yield of 9.6%, M&G offers investors an opportunity to own a stock with a yield nearing 10% for the upcoming years. In the last three years, the dividend has shown a positive growth rate of 7.5%, which aligns with the company stock, which has grown by more than 100% in the same period.

Analysts expect the total dividend for 2023 to be around 19.7p per share, slightly up from the payment of 19.6p in 2022. This payment is projected to increase to 19.87p in 2024.

What is the Target Price for M&G PLC?

MNG stock has a Hold consensus rating on TipRanks, based on four Buy, two Hold, and two Sell recommendations.

At an average price target of 234.97p, the stock has an upside potential of 16% at the current trading levels.

British American Tobacco PLC

BAT is a leading tobacco manufacturing company in the UK that owns a portfolio of renowned brands including Camel, Newport, Dunhill, Vuse, Velo, and more.

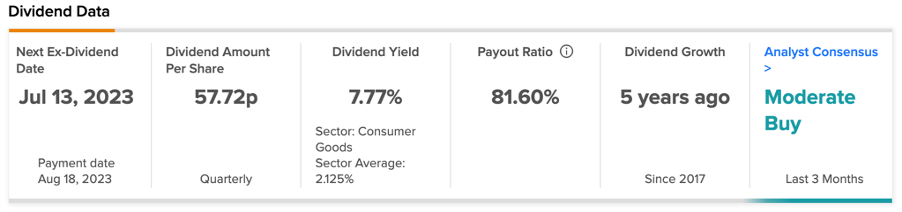

In February 2023, the company declared an interim dividend amounting to 230.9p per ordinary share of 25p. This reflects a 6% growth in dividends over the last year’s payments. This will be paid out in four equal quarterly installments of 57.72p per ordinary share.

Over the last five years, the company has been able to increase its dividend payments to its shareholders. Even though investors remain cautious about the declining sales of traditional cigarettes, the company’s performance in the new category segment demonstrates strong potential for increased earnings and dividends.

Is British American Tobacco Stock a Good Buy?

According to TipRanks’ analyst consensus, BATS stock has a Moderate Buy rating. The stock has a total of 10 recommendations, of which six are Buy.

The average price forecast of 3,279.0p represents a growth of 16% from the current levels.

Admiral PLC

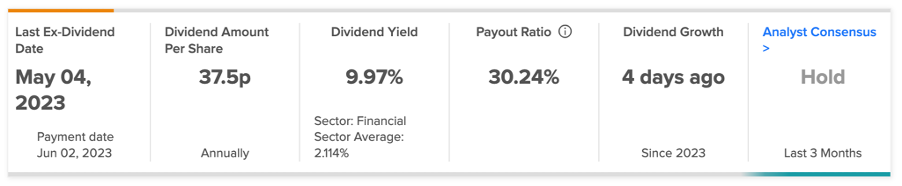

Insurance and financial services company Admiral PLC has a current dividend yield of 9.97%, against the industry average of 2.11%.

However, in 2022, the company cut its dividends by 40% to 112p, as compared to the previous year’s payment of 187p. This was mainly after the company’s yearly profits were hit by its weak performance in the motor division. The company also faced higher claims costs. The company remains optimistic, with 11% growth in its customers in 2022, and believes UK motor insurance is currently at the bottom of the growth cycle.

In 2022, a special dividend of 45p was also paid as a result of the sale of Penguin Portals comparison businesses.

Will Admiral Shares Go Up?

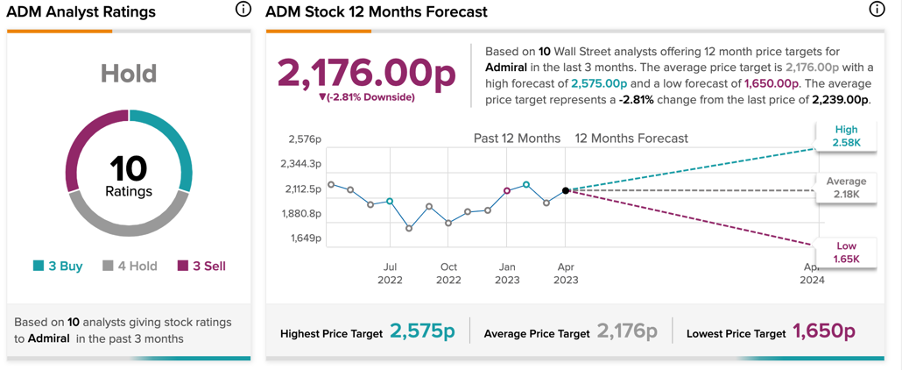

With a total of 10 recommendations, ADM stock has a Hold rating on TipRanks. The average price forecast is 2,176p, which suggests a downside of 2.8% on the current price.

Conclusion

Selecting companies that offer a comparatively high dividend yield can serve as an excellent investment strategy, allowing you to generate additional income. For investors who want to increase the equity exposure in their portfolios while simultaneously earning extra money, these three UK stocks fit perfectly.