German company Merck KGaA (DE:MRK) received positive ratings from analysts despite posting weaker numbers in its half-yearly earnings for 2023. The company warned about a further drop in earnings due to a dip in demand for its products in the semiconductor and pharmaceutical industries.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s shares have been in the red zone over the last year, with a loss of over 11%. Post-results, the share went up by over 2.5%, as the market was prepared for more unfavorable numbers. Analysts remain bullish on the stock and have rated it a Strong Buy.

Merck KGaA develops and provides innovative products and services through its three segments: Life Science, Healthcare, and Electronics. The company has operations in 66 countries worldwide.

Let’s dig deeper into the numbers.

Merck KGaA Q2 Earnings

The company reported its Q2 2023 earnings on August 3. The company’s earnings of €2.20 per share surpassed the estimate of €2.19 per share by analysts.

The company’s sales for the first six months of 2023 were down by 1.6% to €10.5 billion, as compared to €10.76 billion reported in the same period of 2022. In Q2, sales were down by 4.8% to €5.3 billion but were above the analysts’ forecast of €5.22 billion.

Merck’s earnings for the second quarter decreased by 12.8% to €1.55 billion, but they surpassed the consensus forecast of €1.50 billion by a slight margin. For the full year, the company has trimmed its guidance and now expects earnings to fall by 3% to 9%. Earlier, it had been predicted that 2023 adjusted EBITDA would remain stable at a decrease of 5%, factoring in a negative foreign exchange impact of 2% to 5%. Merck’s anticipated business recovery for the second half has been delayed, and the company now expects stabilization at a lower level.

The numbers were impacted due to its Life Science segment, where demand from pharma companies was reduced after COVID-19. The “higher inventory levels from Life Sciences customers” led to lower orders for the company. Moreover, the revision in guidance indicates a deteriorating outlook for this division. On the plus side, the Healthcare segment delivered sales growth of almost 12% in the second quarter of 2023. Analysts expect this trend to continue for the rest of the year, with strong support from oncology and endocrinology product lines.

Analysts’ Opinion

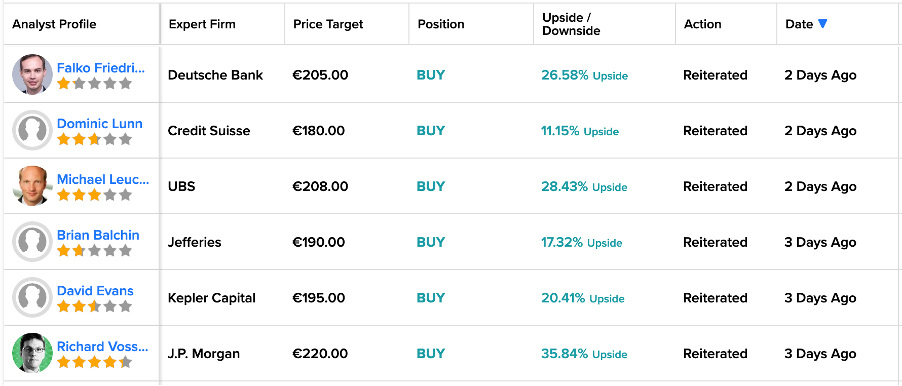

Post-results, analysts have re-confirmed their Buy ratings on the stock. Analysts believe that even though the business recovery has been delayed, the long-term prospects remain intact. The company also expressed its confidence in achieving €25 billion in sales by 2025, despite the current projections for this year ranging from €20.5 billion to €21.9 billion.

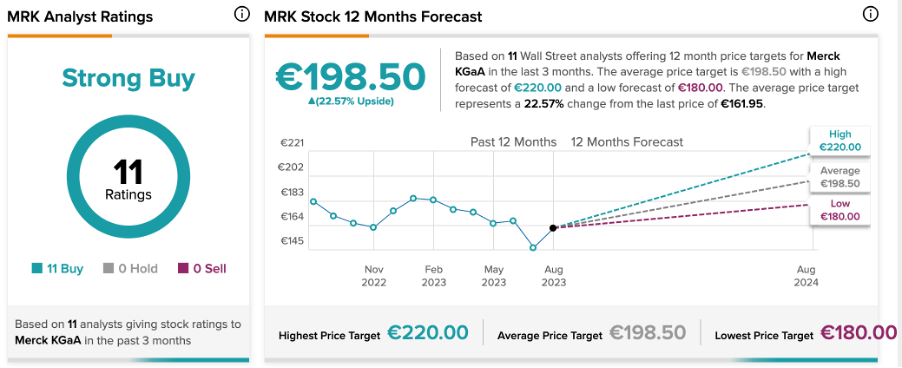

Among these, J.P. Morgan analyst Richard Vosser has the highest price target of €220, which implies a growth of 35.8% in the share price.

What is the target price for Merck KGaA?

According to TipRanks, MRK stock has a Strong Buy rating backed by of all Buy recommendations from 11 analysts.

The average target price is €198.5, which represents a 22.5% change from the current price level.