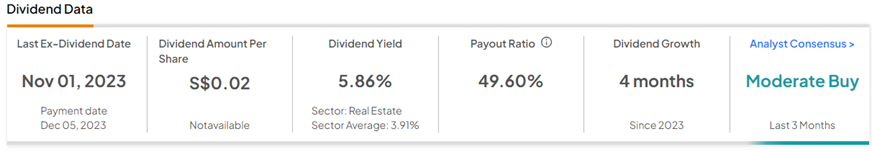

SGX-listed Mapletree Industrial Trust (SG:ME8U) offers an attractive dividend yield of 5.86%, meaningfully higher than the sector average. Mapletree, popularly known as MIT, is a real estate investment trust (REIT). The company owns and manages properties across Singapore, with a portfolio spread across multi-tenanted flatted factories, hi-tech buildings, and business park buildings.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Importantly, analysts have rated ME8U stock a Moderate Buy. Regarding share price appreciation, analysts predict nearly 8% upside potential in the next twelve months.

To find this high dividend-yielding stock, we used the TipRanks’ Top Singapore Dividend Stocks tool. This tool is useful for screening stocks from a particular market and analyzing them across various parameters. It is available across 10 different markets on TipRanks.

MIT’s REITs Status Makes it an Apt Choice

Since Mapletree Industrial Trust is classified as a REIT, it is required to pay 90% of its taxable profits as dividends to shareholders, making MIT an attractive income opportunity. The company’s most recent quarterly dividend of $0.0332 per unit was paid on December 5, 2023.

Importantly, the company announced during its Q2FY24 results that its dividend distribution amount rose 3.5% year-over-year to S$94.1 million. At the same time, its dividend per unit fell 1.2% year-over-year due to a rise in the number of units in issue.

The overall pressure from global inflation, the high-interest rate environment, geopolitical tensions, and diminishing consumer confidence continue to impact the REITs sector. Mapletree is striving to retain tenants and maintain a steady portfolio occupancy level during these tough times.

What is the Price Target for Mapletree Industrial Trust?

On TipRanks, the Mapletree Industrial Trust share price target of S$2.49 implies nearly 8% upside potential from current levels. Also, the ME8U stock has a Moderate Buy consensus rating backed by three Buys, one Hold, and one Sell rating. ME8U shares have gained 8.5% so far this year.