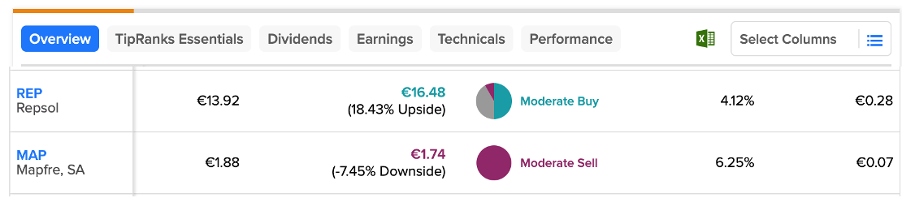

IBEX-listed Mapfre S.A. (ES:MAP) and Repsol S.A. (ES:REP) are two shares from the Spanish market that offer high dividends to investors. According to TipRanks, these companies are among the top five in Spain when it comes to high dividend yields.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In terms of capital growth, Mapfre doesn’t present significant prospects and has been assigned a Moderate Sell rating by analysts. Repsol, on the other hand, offers estimated growth potential of around 19% and has received a Moderate Buy rating.

Here, we have used TipRanks Top Spain Dividend Stocks to choose these prominent dividend-paying companies within this market. This tool empowers users to perform comparisons based on key criteria such as analyst recommendations, price targets, dividend yield, and other pertinent metrics.

Let’s take a look at some details.

Repsol S.A

Repsol is a Spanish energy company involved in a wide spectrum of activities, including exploration and production, refining, and the distribution and promotion of specialized products like crude oil, natural gas, and electricity.

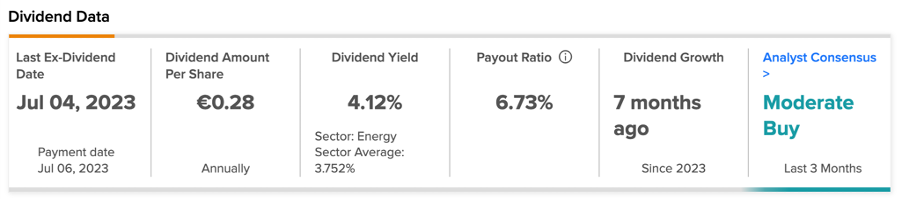

The company has a dividend yield of 4.12%, making it one of the more appealing choices among companies listed on the IBEX. During its first-half earnings for 2023 reported in July, the company announced a final gross dividend of €0.35 per share. Combined with the same amount paid in January, Repsol’s total cash dividend is €0.70 per share, marking an 11% increase compared to the previous year. In 2022, the gross dividend totaled €0.63 per share.

The dividend will see a progressive increase to €0.75 per share over the course of the strategic plan by 2025.

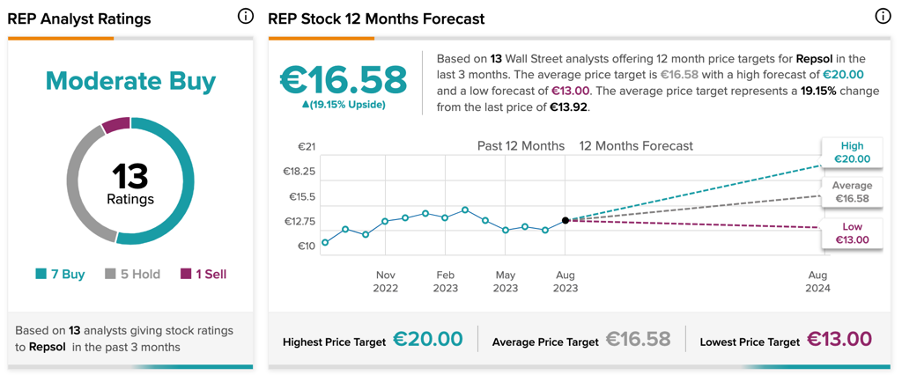

Is Repsol Stock a Buy?

According to TipRanks, REP stock has a Moderate Buy with a total of 13 recommendations from analysts. It includes seven Buy, five Hold, and one Sell ratings. The average price target is €16.58, which is 19.15% higher than the current price level.

Mapfre S.A.

Based in Spain, Mapfre is an insurance company operating in 45 countries worldwide. It offers a diverse range of insurance products, including automobile, homeowners, health, and life coverage, in addition to providing reinsurance services. The company has a strong presence in the markets of Mexico and South America.

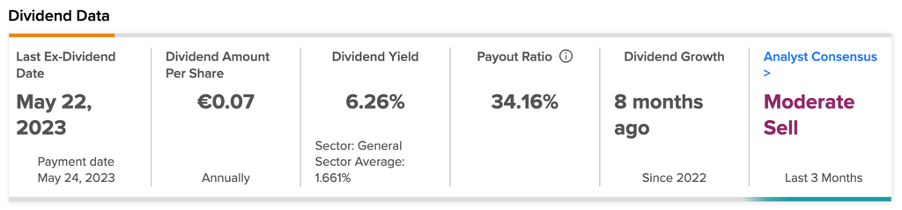

The company has a dividend yield of 6.26%, above the sector average of 1.66%. In May 2023, the company concluded its dividend distribution for 2022 by paying a final dividend of €0.07 per share. This resulted in a total annual dividend of €0.12 per share, aligning closely with the dividends paid by the company prior to the pandemic.

Recently, the company announced its Q2 2023 earnings with a 17% growth in its revenues of €17 billion. The company’s results reflect a strong performance in the LATAM region, with a growth rate of over 20%. The region stands out as the primary driver of earnings, with net results surging to €193 million.

Mapfre Stock Forecast

MAP stock has a Moderate Sell rating based on two Sell recommendations. The average price forecast of €1.74 is 7.2% lower than the current price level.

Conclusion

For investors seeking to boost their passive income, these stocks could be worth considering as potential additions to their portfolios.

Among these options, Mapfre has garnered a Moderate Sell rating from analysts, predicting a potential decline of 7.15%. Conversely, REP holds a Moderate Buy rating and offers a growth potential of 19% in its share price.