Spanish companies Mapfre S.A. (ES:MAP) and CaixaBank (ES:CABK) are providing investors with a dividend yield exceeding 5%. Additionally, they hold a position within the top 10 companies in Spain when it comes to their highest dividend payouts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In terms of capital growth, Mapfre does not offer substantial opportunities, earning a Moderate Sell rating from analysts. CaixaBank, on the other hand, exhibits a growth potential of approximately 18% and has received a Moderate Buy rating.

Here, we have used TipRanks Top Spain Dividend Stocks to pick from the leading dividend-paying companies in this market. This tool enables users to conduct comparisons using essential criteria like analyst recommendations, price targets, dividend yield, and other relevant metrics.

Let’s take a look at some details.

CaixaBank, SA

CaixaBank is a prominent financial services conglomerate in Spain, providing a comprehensive range of banking, insurance, asset management, and investment solutions to both individuals and corporations.

The bank carries a dividend yield of 5.12%, higher than the sector average of 2.14%. For 2022, the bank paid a total dividend of €0.23 per share, which is 58% higher as compared to the previous year. It also experienced an increase in its dividend payout ratio, with the ratio rising from 50% of earnings to 55% of profits. In 2022, CaixaBank’s capital requirement stood at a mere 8.3%, indicating the presence of a considerable capital buffer. This robust position allows the company to effectively allocate surplus capital to shareholders.

Moving forward, CaixaBank’s dividend is expected to rise to €0.29 per share by 2024, resulting in a dividend yield surpassing 8%.

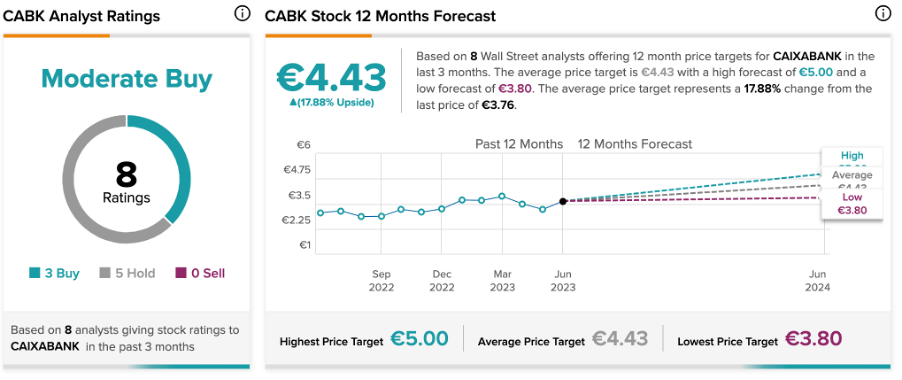

CaixaBank Share Price Forecast

According to TipRanks, CABK stock has a Moderate Buy with a total of eight recommendations from analysts. It includes three Buy and five Hold ratings. The average price target is €4.43, which is 18% higher than the current price level.

Mapfre S.A.

Mapfre is a Spanish insurance company operating in more than 45 countries globally. The company provides various types of insurance, like auto, home, health, and life, along with reinsurance services.

The company has a dividend yield of 6.35% and a 70% payout ratio. It retains 30% of the earnings to enhance the balance sheet’s strength, which assists in mitigating the impact of certain unrealized losses on the investment portfolio. The company paid a final gross dividend of €0.085 per share for 2022 in May 2023. This culminated in total dividends of €0.145 per share for the year, similar to the dividends paid by the company before the pandemic.

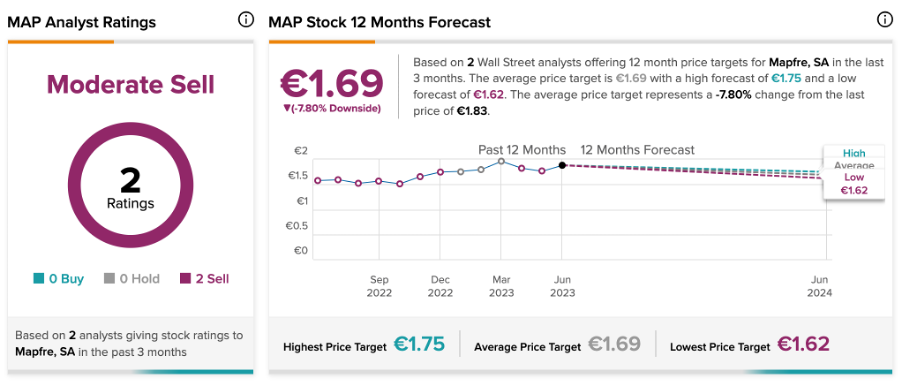

Mapfre Stock Forecast

MAP stock has a Moderate Sell rating based on two Sell recommendations. The average price forecast of €1.69 is 7.8% lower than the current price level.

Conclusion

Investors looking to boost their passive income may want to consider adding these stocks to their portfolios as potential options.

Among them, Mapfre has received a Moderate Sell rating from analysts, projecting a downside of 7.8%. On the other hand, CBK has a Moderate Buy rating and 18% growth potential in its share price.