The valuation of the SGX-listed Manulife US REIT’s (SG:BTOU) real estate portfolio has decreased by 8% from $1.5 billion at the end of the first half to $1.4 billion as of December 31, 2023. The decline in its four properties – Figueroa (California), Plaza (New Jersey), Penn (Washington, D.C.), and Diablo (Arizona), accounted for around 54.2% of the overall downfall.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Manulife US REIT is a real estate investment trust (REIT) listed on the SGX. The REIT mainly focuses on direct or indirect investment in income-generating office real estate in the U.S.

Reasons for the Declined Valuation

The decline in valuation is due to various factors, such as increased discount rates and terminal capitalization rates for specific properties. These adjustments reflect the perceived risks associated with the volatile macroeconomic environment.

Moreover, the decline is attributed to weak occupancy rates throughout the U.S. office market. Over recent years, the company has encountered multiple challenges, including the impact of the COVID-19 pandemic and increasing interest rates. These factors have created difficulties in the U.S. office market, resulting in a decline in the valuation of the company’s assets and higher leasing costs. Looking ahead, the company expects to register losses in its full-year results for FY23, which are scheduled to be released on February 6, 2024. Also, it anticipates that valuations could further decline in 2024.

Manulife US REIT Share Price Under Pressure

Last year was quite rough for the company’s shares, with a loss of around 70% in trading. Over the last two months, the stock witnessed a roller-coaster ride due to the news about its recapitalization plan. On November 30, the stock experienced a significant drop of 27.5%, triggered by the company’s announcement of a $236 million recapitalization plan.

On December 14, 2023, the company passed its recapitalization plan, duly signed by its unit holders. The company has expressed confidence in this plan and expects a recovery in its operations in the times ahead.

Analysts’ Ratings

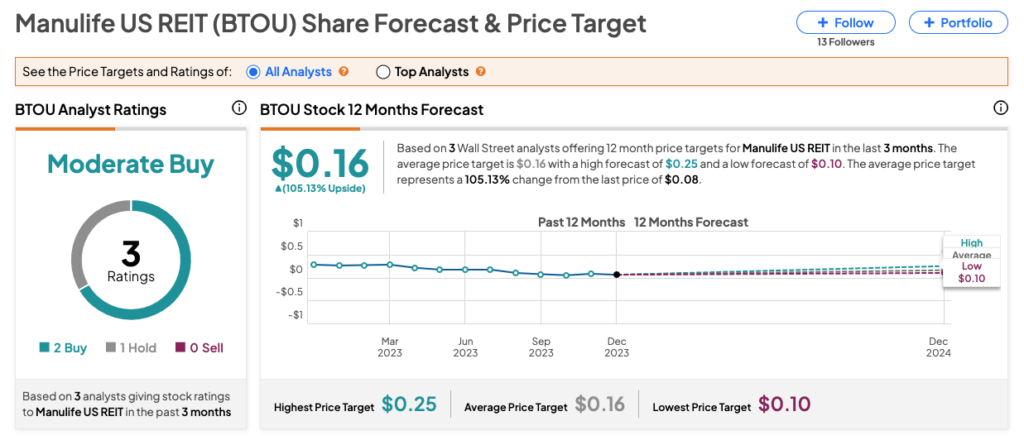

On TipRanks, BTOU stock has been rated as a Moderate Buy, backed by two Buys and one Hold recommendation. The Manulife US REIT share price target is $0.16, which implies a huge upside of over 105% from the current trading levels.