SGX-listed Singapore Technologies Engineering (SG:S63) has agreed to acquire D’Crypt from Starhub (SG:CC3) for S$67.5 million. Adding D’Crypt will bolster ST Engineering’s cybersecurity business by providing a full stack of information technology (IT) and operational technology (OT) solutions for critical infrastructure and high-security enterprises.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ST Engineering is a multinational technology and engineering company offering solutions in the aerospace, smart city, defence, and public security sectors. Meanwhile, D’Crypt specializes in cryptographic technology and components that are integral to customers’ information security appliances, systems, and applications.

The proposed takeover also includes a S$5 million earn-out consideration, contingent on meeting certain earn-out milestones. Importantly, the deal is cash-free and debt-free and is expected to be earnings accretive to ST Engineering in the second year of completion. Also, the proposed acquisition is expected to be cash flow positive in the first year itself. For Starhub, divesting D’Crypt will allow it to focus on its 3Ccloud, cyber security, and connectivity.

Is ST Engineering a Good Buy Now?

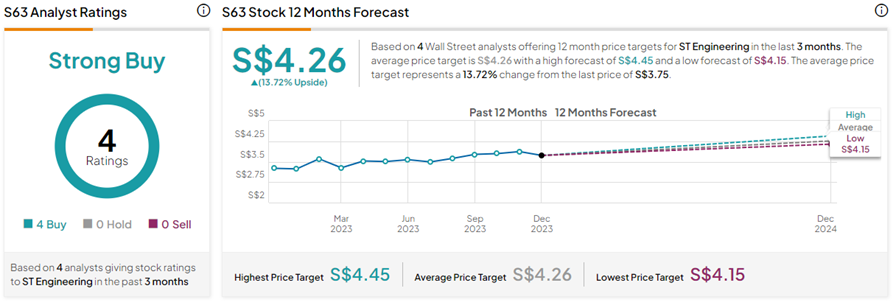

With four unanimous Buy ratings, S63 stock commands a Strong Buy consensus rating on TipRanks. The ST Engineering share price target of S$4.26 implies 13.7% upside potential from current levels. But all these ratings were given before the acquisition’s announcement and are subject to change. Year-to-date, S63 shares have gained 16.1%.