Australian drug retailer Sigma Healthcare (AU:SIG) and private pharmacy player Chemist Warehouse Group (CWG) have agreed to merge, forming a giant healthcare player valued at AU$8.8 billion. CW will have an 85.75% stake in the new entity, while Sigma shareholders will hold the remaining 14.25%. The company will find a place within Australia’s most coveted benchmark S&P/ASX 200 index.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Sigma Healthcare is an ASX-listed pharmacy company that manages over 1,200 brands and independent pharmacies. CW Group, on the other hand, is one of Australia’s most prominent retail pharmacy chains. CW has over 600 stores offering prescription drugs, over-the-counter medicines, health and beauty products, etc. The combined entity will form a massive healthcare wholesaler, distributor, and retail pharmacy franchise in Australia. The merger is subject to approval by the Australian Competition and Consumer Commission (ACCC).

Details of the Merger

Per the terms of the deal, Sigma will pay AU$700 million in cash and raise new equity for CW shareholders. Sigma has obtained a new debt facility of AU$1 billion to finance the deal. Plus, it will raise AU$400 million in fresh equity through an underwriting offer to fund the working capital requirement. Importantly, the merged company is estimated to earn AU$60 million in annual cash savings from the fourth year of the merger.

Regarding the management shuffle, Sigma’s current CEO, Vikesh Ramsunder, will continue the leadership role in the new merged entity. Meanwhile, Sigma Chairman Michael Sammells will continue to chair the board. At the same time, CW co-founder and CEO Mario Verrocchi will lead the pharmacy business and take up the executive director role, with co-founder Jack Gance also taking a seat on the board.

Is Sigma a Buy or Sell?

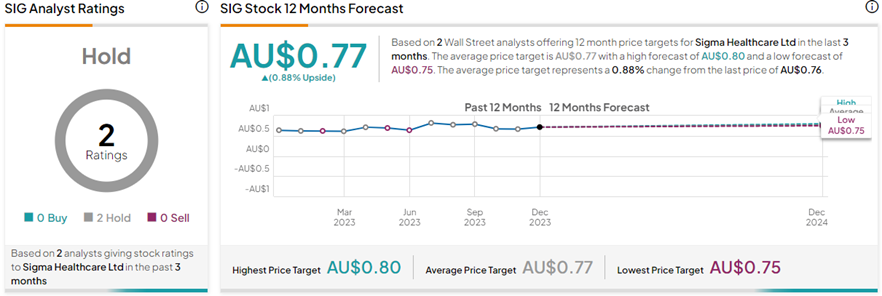

With two hold ratings, SIG stock has a Hold consensus rating on TipRanks. The Sigma Healthcare share price target of AU$0.77 implies that shares are almost fully valued at current levels. Please note that both these ratings were given before the merger was announced and are subject to change. Year-to-date, SIG shares have gained nearly 28%.