U.K.-based retailing giant Frasers Group (GB:FRAS) has bolstered its luxury portfolio by acquiring 100% of e-commerce retailer Matches from Apax Partners in a £52 million deal. The acquisition is part of Frasers’ “elevation strategy,” under which the company is attracting more brands and acquiring minority stakes in rival retailers. Following the news, FRAS stock touched a fresh 52-week high of 942.50p in regular trading on December 20.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Rationale Behind the Deal

FTSE 100-listed Frasers Group is one of the largest sports goods and clothing retailers, offering a portfolio of brands such as Dunlop, Lonsdale, Nike, Adidas, Under Armour, Puma, and Karri. Its Sports Direct retail chain is one of the most popular sports clothing and equipment retailers across Britain and Europe. Its clothing chain includes GAME, Flannels, USC, Jack Wills, and Evans Cycles. Year-to-date, FRAS shares are up 32%.

Meanwhile, London-based Matches Fashion is an online premium luxury clothing retailer delivering to 150 countries outside of the U.K. Matches offers premium clothing from over 450 designers. Despite its strong standing, Matches has been making losses in recent years. The post-pandemic years have witnessed a softening demand for luxury goods as inflation-stricken consumers stick to necessities.

Even so, Frasers is confident about Matches’ future performance. Frasers CEO Michael Murray believes that Matches can leverage Frasers’ well-established ecosystem to drive synergies and profits in the long term. Frasers will fund the acquisition with an existing cash balance. Further, Matches’ current CEO, Nick Beighton, will remain in the company and help Frasers strategize, focus on its core strength, and build successful synergies.

Is Frasers Group a Buy or Sell?

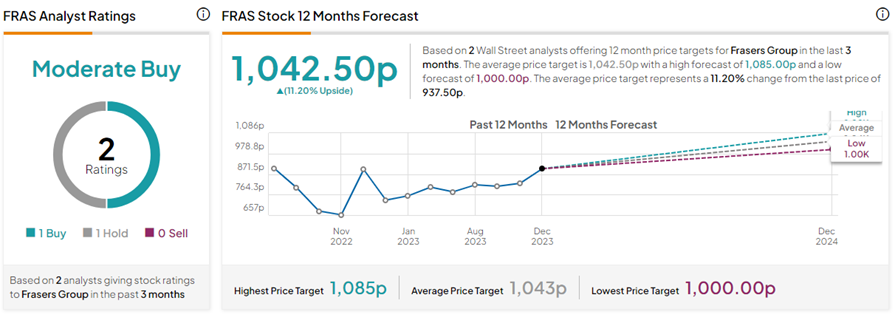

On TipRanks, FRAS stock has a Moderate Buy consensus rating based on one Buy and one Hold rating. The Frasers Group share price forecast of 1042.50p implies 11.2% upside potential from current levels.