ASX-listed BWP Trust (AU:BWP) has proposed to acquire Newmark Property REIT (AU:NPR) in an all-scrip deal for a total equity value of AU$246.8 million. The deal presents an opportunity for both companies to merge their complementary assets to create a huge combined portfolio valued at AU$3.5 billion. BWP Trust’s stock experienced a 2.02% decline today, whereas NPR shares saw a substantial gain of 36.6% in trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

BWP Trust is a real estate investment trust (REIT) that invests and manages commercial properties across Australia. It owns most of the properties of home improvement retailer Bunnings. The REIT is managed by BWP Management Limited, which is a wholly-owned subsidiary of Wesfarmers Limited (AU:WES).

Meanwhile, Newmark Property also owns a portfolio of strategically located retail properties, primarily leased to businesses affiliated with Wesfarmers.

Details of the Acquisition

As per the terms of the deal, NPR shareholders will receive 0.4 BWP units for each share of NPR. BWP stated that the current offer carries an implied value of AU$1.39 per Newmark share, calculated at a price of AU$3.47 per BWP unit. This represents a significant 43.1% premium over Newmark’s closing price of AU$0.97 on January 23, 2024.

Furthermore, it enables BWP to strategically add nine retail assets in prime locations, in line with its long-term value generation strategy. This acquisition will expand BWP’s portfolio to 84 properties, marking a 20% increase.

The deal also highlights the quality of tenants, safeguarding rental income in the future. As of now, NPR’s assets are 73% leased to Wesfarmers tenants, which will increase to 82% upon the deal’s completion. The inclusion of NPR’s properties will positively impact BWP’s weighted average lease expiry profile, increasing it from 3.6 years to 3.9 years.

The deal will not have any impact on BWP’s dividend guidance for the second half of FY24, which is expected to be 9.27 cents.

Is BWP Trust a Good Investment?

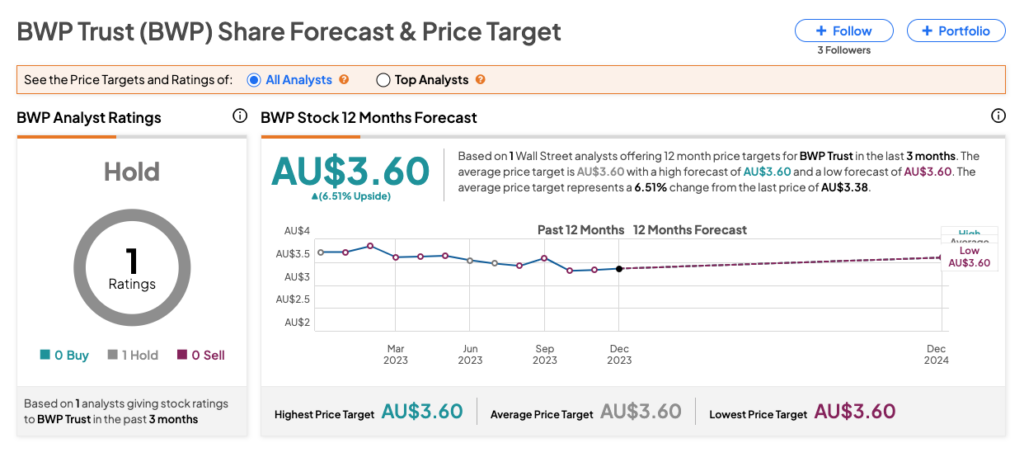

On TipRanks, BWP stock has received a Hold consensus rating based on one Hold recommendation from Ord Minnett. The BWP Trust share price target is AU$3.60, which is 6.5% above the current trading levels.

It’s worth mentioning that these ratings were assigned before the deal’s announcement and may be subject to revision in light of the new developments.