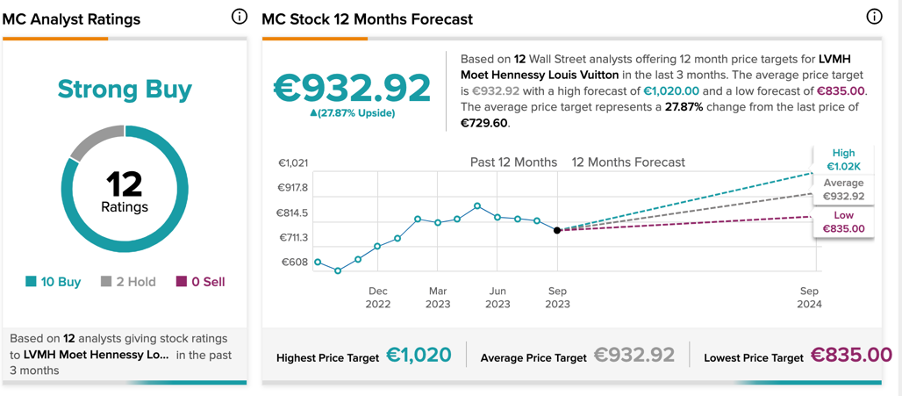

According to analysts, the share price of the French luxury company LVMH Moët Hennessy Louis Vuitton, or LVMH (FR:MC) is expected to grow by around 30%. Analysts have an optimistic outlook on the stock, rating it a Strong Buy. However, they have lowered their price targets and anticipate some short-term volatility.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Recently, LVMH stock lost its spot as the most valuable company in Europe to Danish healthcare giant Novo Nordisk A/S (NYSE:NVO). This ended a 2.5-year long run for the company, hit by growing concerns about the Chinese economy and a slowdown in U.S. revenues. This further added to investors’ woes, particularly in light of the company’s underwhelming performance in the U.S. in Q2 2023. Consequently, the LVMH share price has been on a downward trend over the last six months, experiencing a 9% decline in trading.

LVMH is a leading European conglomerate renowned for its ownership of approximately 75 luxury brands, including Dior, Louis Vuitton, Sephora, Fendi, Bulgari, etc. The company’s diverse product portfolio includes bags, watches, cosmetics, wine, perfumes, and more.

What are Analysts Predicting?

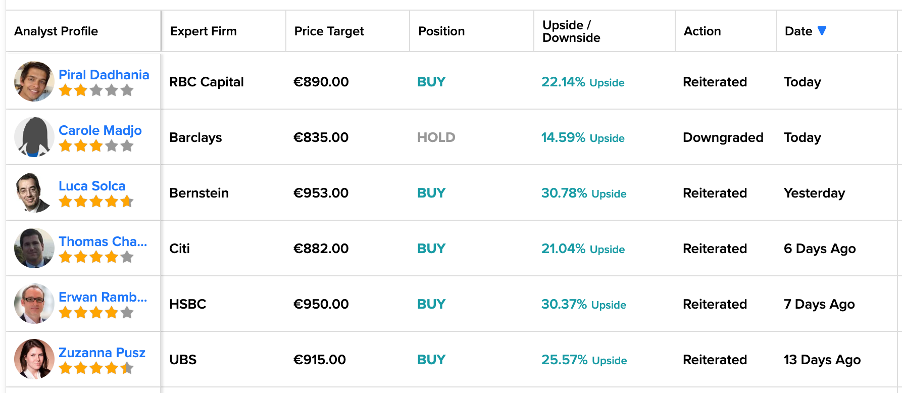

Today, Barclays analyst Carole Madjo downgraded her rating on the stock from Buy to Hold. Madjo believes that luxury product companies are struggling to improve their sales in China, which will “weigh further on their stock prices.” She lowered her target price from €932 to €835 (upside of 14.6%). Madjo also remains concerned about the luxury goods sector due to worsening macroeconomic indicators from China, and changed her industry view from positive to neutral.

On the contrary, analyst Piral Dadhania from RBC Capital confirmed his Buy rating on the stock today, suggesting a growth of 22%. He reduced his price target from €940 to €890.

Yesterday, Luca Solca from Bernstein reiterated his Buy rating on the stock with a price target of €953. This implies an upside potential of 30.8% in the share price.

What is the Future Price of LVMH Stock?

MC stock has received a Strong Buy rating on TipRanks, backed by a total of 12 recommendations from analysts. It includes 10 Buy and two Hold ratings. The LVMH share price target is €932.92, which is 28% higher than the current trading level.