French luxury group LVMH Moët Hennessy Louis Vuitton, or LVMH (FR:MC), delivered impressive revenue for the fourth quarter of 2023, defying macro pressures. The company’s fourth-quarter revenue grew 5.5% year-over-year to €23.9 billion, slightly ahead of analysts’ estimate of around €23.6 billion. The top line reflected a marked improvement from the 1% revenue growth in the third quarter. The fourth quarter revenue grew 10% on an organic basis, better than 9% in Q3 2023. LVMH shares were up 9% as of writing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

LVMH is one of the world’s largest makers of luxury goods. It owns several popular labels, including Louis Vuitton, Dior, Bulgari, and Tiffany.

LVMH’s Resilient Results

For the full year 2023, LVMH’s revenue of €86.15 billion surpassed analysts’ forecast of €85.74 billion and grew 13% on an organic basis. All the segments reported impressive organic revenue growth except the Wines & Spirits business, which was weighed down by tough comparisons and high inventory levels. Coming to region-wise performance, Europe, Japan and the rest of Asia generated double-digit organic revenue growth.

The full-year net profit increased nearly 8% to €15.17 billion but slightly missed analysts’ estimate of €15.68 billion. The bottom line was impacted by currency headwinds in the second half of the year.

Overall, LVMH’s 2023 performance reflected resilience, given the tough macroeconomic backdrop in key markets. However, the company still lags the strong post-pandemic surge that it experienced when customers splurged money on high-end goods. The pent-up demand for luxury goods started fading due to elevated interest rates.

Looking ahead, management is confident about the company’s performance this year. Also, LVMH proposed a dividend of €13 per share, up from the prior-year’s payment of €12 per share. The company’s final dividend of €7.50 per share will be paid on April 25, 2024.

Separately, the group confirmed the nomination of Alexandre Arnault, Frédéric Arnault, and French businessman Henri de Castries to the board of directors at the upcoming annual general meeting, to be held on April 18. The move is a part of LVMH’s efforts to bolster the Arnault family’s hold on the company.

Is it Worth Investing in LVMH?

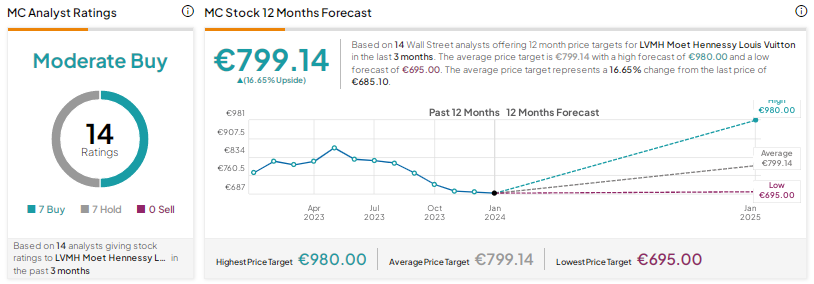

LVMH shares have declined more than 14% over the past year. Analysts are cautiously optimistic about LVMH stock, given the ongoing macro uncertainty in key markets and geopolitical tensions.

With seven Buys and seven Holds, MC shares score a Moderate Buy consensus rating. The LVMH Moët Hennessy Louis Vuitton share price target of €799.14 implies nearly 17% upside potential. However, analysts could revise their ratings and/or price targets in reaction to the company’s results and management’s commentary.