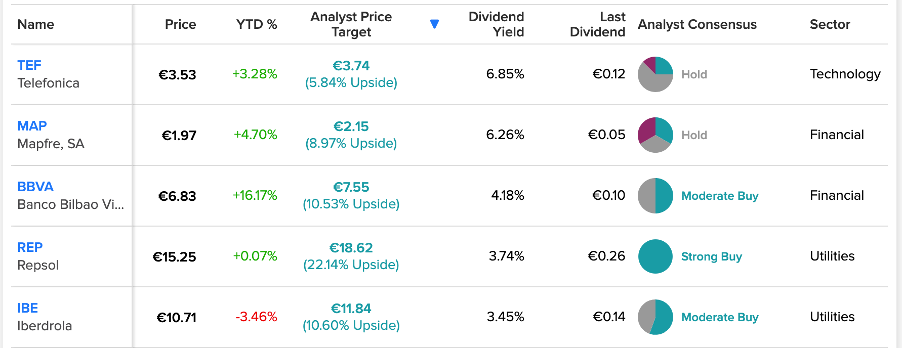

Using the Top Dividend Stocks tool for the Spanish market, we have shortlisted the top five stocks. These stocks have higher dividend yields, surpassing their respective sector’s averages.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This tool could be a perfect helping hand for investors while choosing dividend stocks. It also helps in comparing these stocks against each other on different parameters.

Let’s have a look at the details.

1. Telefonica S.A. (ES:TEF)

Spanish telecommunications company, Telefonica has a dividend yield of 6.79%, as compared to its sector average of 1.03%. In 2022, the company announced a dividend of €0.30 per share, payable in two equal installments in December 2022 and June 2023.

TEF stock has a Hold rating on TipRanks and a target price of €3.74.

2. Mapfre S.A (ES:MAP)

Insurance provider Mapfre has a better dividend yield of 6.26% than the sector average of 2.11%. The company has paid consistent dividends over the last five years. In 2022, the company announced its interim dividend as €0.05 per share, paid in November 2022.

On TipRanks, MAP stock has mixed recommendations from analysts with an overall rating of Hold.

3. Banco Bilbao Vizcaya Argentaria (ES:BBVA)

BBVA is a global financial services company based in Spain. The company has a much better dividend yield of 4.22% as compared to its peers. The sector average is 2.11%. The company’s last declared dividend in 2022 was an interim dividend of €0.12 per share, which was 50% higher than the previous year.

BBVA stock has a total of 12 recommendations on TipRanks, with an overall rating of Moderate Buy.

4. Repsol SA (ES:REP)

Repsol is an energy company with operations in over 100 countries. The company declared a dividend of €0.63 per share in 2022, with the goal of increasing it to €0.75 per share by 2025. Repsol has a dividend yield of 3.62%.

REP stock has a Strong Buy rating with all nine Buy recommendations. The stock has an average target price of €18.62, which has an upside potential of 22.14%.

5. Iberdrola SA (ES:IBE)

Iberdrola is among the leading energy companies focused on the renewable space. The company’s dividend yield is 3.46%, as compared to the industry average of 2.9%. According to the company’s policy, its dividend will be between 65% and 75% of its net profits. The interim dividend for 2022 was €0.14 per share.

IBE stock has a Moderate Buy rating with a target price of €11.84, which is 10.6% higher than the current trading price.